In a May 13 research note, analyst David Talbot reported that Red Cloud Securities initiated coverage on Skyharbour Resources Ltd. (SYH:TSX.V; SA:NYSE.MKT), "a maverick in basement exploration," with a Speculative Buy rating and a CA$0.95 per share target price. The stock's current share price is about CA$0.51 per share.

Talbot described the Vancouver-based uranium explorer and what makes it an attractive investment opportunity.

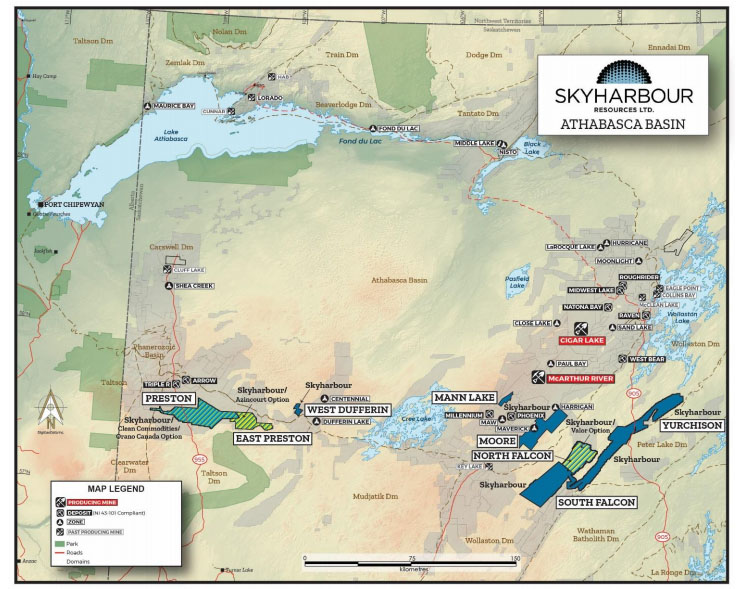

Skyharbour owns 100% of the Moore uranium project, on which it is currently focusing its efforts, but it also owns 100% of the Hook Lake, South Falcon Point and Mann Lake properties, along with 15% of the Preston project, Talbot noted. Recent drilling at Preston by the option partner showed anomalous uranium intercepts and indicator minerals.

"While Skyharbour does have a pipeline of projects and considers itself a project generator to help limit dilution and risk, prospectivity of the Moore uranium project makes it one of the more established junior uranium exploration companies," Talbot wrote.

As for Moore, it has several advantages, noted Talbot. Location is one. It sits in the eastern Athabasca Basin, a prolific uranium district hosting high grades and home to many top-tier projects, such as Key Lake, McArthur River, Wheeler River and Cigar Lake. The region is mining friendly and offers an experienced workforce and ample infrastructure.

Also, Moore is "gaining critical mass," Talbot wrote. The Maverick zone now spans about 170 meters (170m) along strike, 20m in width and 17m in thickness. It features a weighted average uranium grade of 1.5%. The high-grade intercepts encountered in Maverick on drilling include 6% U3O8 over 5.9m, including 20.8% over 1.5m, and 4.03% U3O8 over 10m, including 20% over 1.4m.

The Maverick East zone occurs in the basement rocks and has a strike length of about 170 meters. It is "about half the grade and somewhat narrower but open. High grade hits include 1.79% over 11.5m including 4.17% over 4.5m and 9.12% over 1.4m," Talbot wrote.

Further, Moore offers significant upside as it remains "underexplored" despite previous drilling, 390 drill holes over 150,000 meters, having been done there, most of it historical, Talbot pointed out. Only 2.5 kilometers (2.5 km) of the 4.7 km long trend have been drilled to date, and the main Moore Lake corridor is still mostly untested.

"We estimate a growing mineral inventory of about 7 million pounds of U3O8 between the Maverick and Maverick East zones," Talbot wrote. "We also see potential for further high-grade discoveries from up to 18 different target areas of the property to drive the stock."

Skyharbour continues to explore at Moore. It plans at least 3,500m (seven to eight holes) of diamond drilling to begin this summer. The company intends to drill deeper into basement rocks and in an area, identified on recent electromagnetic geophysical surveys, where two major conductive structures (Rarotonga and East Venice) intersect.

Near-term catalysts for the uranium firm are drill results from Moore and East Preston.

"With two highly prospective projects to advance in a top uranium mining district, we see potential for a new discovery," Talbot wrote.

As for financing and backing, Skyharbour has $6 million in cash and $2.5 million in short-term investments. The company has a strategic partner in Denison Mines, which owns about 11% of Skyharbour. "Denison has knowledge on in situ recovery mining and Sabre mining processes that may come in handy," Talbot noted.

Read what other experts are saying about:

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Skyharbour Resources. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Skyharbour Resources, a company mentioned in this article.