Uranium is an important strategic metal. Canada-based Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) is a high-grade uranium exploration and early-stage development company with an extensive portfolio of uranium exploration projects in Canada's Athabasca Basin, located in the province of Saskatchewan.

The company holds a wide portfolio of exploration projects, ranging from more advanced stage exploration assets to earlier stage, secondary assets. The portfolio includes Moore, Russell Lake, South Falcon Point, South Falcon East, Preston, East Preston, Hook Lake, Mann Lake, Yurchison, Riou River, Pluto Bay, Wallee, Usam Island, Foster River, Highway, Highrock West, Highrock East, and South Dufferin.

The projects are located across the Athabasca Basin, with the co-flagship Moore Project approximately 15 kilometers east of Denison's Wheeler River project and 39 km south of Cameco's McArthur River uranium mine.

Skyharbour's latest drilling announcement involves the 73,294-hectare co-flagship Russell Lake Uranium property, which is situated in the central core of the eastern Athabasca Basin of northern Saskatchewan, and adjacent to the company’s 100% owned Moore Lake Project.

Smaller holdings in the firm's portfolio include the 32,006 hectare South Falcon Point Project, located 50 km east of the Key Lake mine, and the12,464 hectare South Falcon East Project, recently optioned to Tisdale Clean Energy, located 18 km outside the Athabasca Basin, and approximately 55 km east of the Key Lake mine.

The Catalyst: 10,000 Meters of New Drilling

Nick Coltura, Investor Relations Manager at Skyharbour Resources, provides investor relations services for Skyharbour and is quite excited about the new drill program at the Russell Lake project.

The Athabasca Basin is consistently ranked as a top-5 mining district by the Fraser Institute, and its location in Canada ensures more geopolitical stability than many uranium-bearing regions.

"Russell has had a fair bit of historical drilling, but it was exploratory drilling with widely spaced drill fences typically 300-500m apart, and in some cases, both drill fences were mineralized. The previous operators didn't tighten the spacing up as much, so our initial plan is to conduct systematic programs to drill in between those fences. We believe there could be high-grade, significant zones of uranium mineralization in between these historical exploratory holes, and we are very excited to test this," he explained in a recent phone call. "In addition to this initial strategy, we are fine-tuning other regional targets at the property as there is no lack of highly prospective drill targets on the large land holding."

Regarding the company's overarching goals, he explained that Skyharbour is "trying to be a one-stop shop for uranium discovery, drilling, and exploration." He's particularly bullish about where the company's projects are located. He explained, "We are in the best place in the world to be advancing and developing uranium projects."

The Athabasca Basin is consistently ranked as a top-5 mining district by the Fraser Institute, and its location in Canada ensures more geopolitical stability than many uranium-rich regions.

Why This Sector? Powering the Future

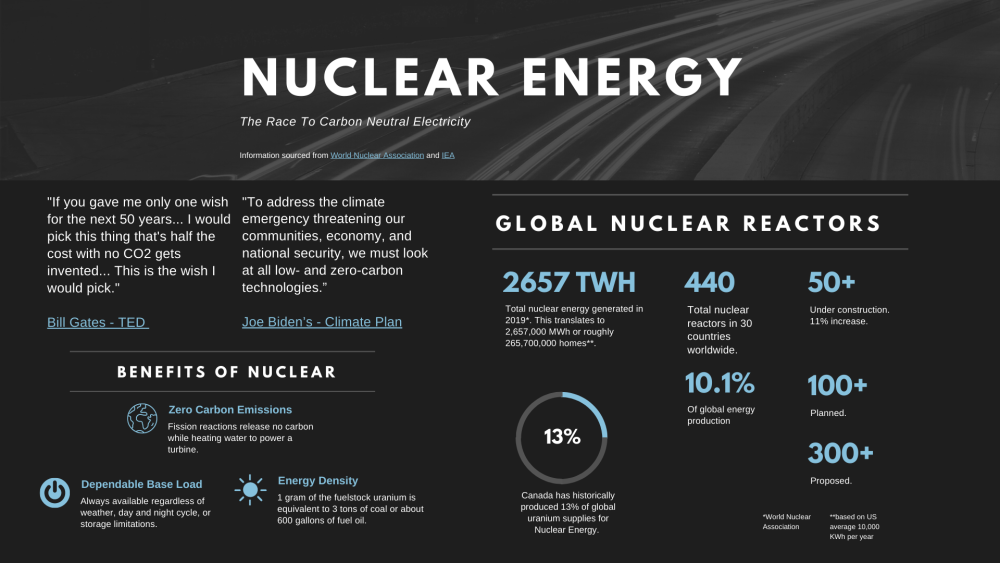

Uranium is incredibly important as it is used for nuclear fuel. Natural uranium found in the Earth's crust is a mixture of two isotopes, with Uranium-235, which is ideal for use in nuclear reactors, making up only about 0.7% of the total mineral weight.

Under certain conditions, Uranium-235 can readily be split, yielding a lot of energy. It is therefore said to be "fissile," from which we derive the term "nuclear fission."

According to a joint report by the Nuclear Energy Agency (NEA) and the International Atomic Energy Agency (IAEA), global uranium output in 2020 met nearly 90% of world reactor demand, dropping from 95% in 2017. Excess government and commercial inventories covered the remaining demand.

According to technical analyst Clive Maund, "Skyharbour has a lot of uranium exploration projects in Canada, many of which are drill ready. With commodities generally and uranium in particular expected to continue in an accelerating bull market against the background of increasing inflation, Skyharbour stock looks set to do well."

Existing world reactor requirements up to 2040 are projected to consume about 87% of the total 2019 identified resource base of 6,147,800 tonnes, creating ongoing tight market conditions.

The outlook around the nuclear and uranium mining industries has changed significantly over the past several years and continues to improve, thanks to three primary trends: decarbonization/clean energy, electrification, and energy security/independence.

Current global geopolitical unrest has only grown demand for uranium against the backdrop of a strained supply side further tightened by new financial entities sequestering material out of the market like Sprott Physical Uranium Trust.

As the world transitions from carbon-intensive sources of electricity to carbon-free ones, many nations aim to be carbon-neutral by 2050. Countries are rethinking nuclear, as it is the only viable energy source providing baseload, emissions-free, affordable, and scalable power.

Why This Company? Large, Drill-Ready Portfolio

According to a February 17, 2022 report by analyst Clive Maund, "Skyharbour has a lot of uranium exploration projects in Canada, many of which are drill ready."

"With commodities generally and uranium in particular expected to continue in an accelerating bull market against the background of increasing inflation, Skyharbour stock looks set to do well," he explained.

Why Now?

Experts believe Skyharbour Resources is well-positioned to benefit from improving uranium fundamentals as the uranium market bifurcates. Western nuclear utilities are looking to shore up material from western suppliers as Russia is carved out from western demand.

With a total portfolio of 18 projects covering over 1.2 million acres, the firm is actively advancing its core assets, including Moore and Russell Lake, while using a prospect generator model to option out secondary properties to partner companies who fund the exploration and pay Skyharbour cash and shares to earn in.

Skyharbour now has seven partner companies having signed option agreements that total over CA$34 million in partner-funded exploration expenditures, over CA$22 million in stock being issued, and just under CA$15 million in cash payments coming into Skyharbour assuming the partner companies complete their earn-ins.

"The last 12 months have been significant for Skyharbour," according to firm management, "and we believe that the next 12 to 18 months will continue to be transformational for our shareholders."

According to Peter Epstein at Epstein Research, "Management is focusing the majority of its largest-ever drill program at Russell. If meaningful discoveries are made at Russell or ML, that would draw a lot of attention to the story. Either as satellite deposits for a nearby mill or a standalone mine — sizable high-grade endowments would be mined."

"We've recently optioned the Russell Lake Uranium Project from Rio Tinto, bringing them on to be a strategic shareholder of the company. The large, 73,000-hectare property hosts numerous high-grade uranium intercepts in historical drill holes and holds several high-priority target areas with the potential to generate new discoveries."

"After extensive data compilation, interpretation, and new geological modeling, our geological team has refined and selected the highest-priority drill targets. We have plans to rapidly advance the project through multiple phases of drilling over the next 12 months, utilizing existing roads and infrastructure in the area."

In conjunction with the Russell Lake Project, Skyharbour plans to continue to advance its 100% owned co-flagship Moore Project, an advanced-stage uranium exploration property with high-grade uranium mineralization.

"We have plans to continue drilling the project as large portions of the high-grade Maverick corridor have yet to be systematically tested, leaving robust discovery potential along strike as well as at depth in the basement rocks," the company explained. "There are several high-priority regional targets at the project that display strong discovery potential as well."

Skyharbour is tentatively expecting a minimum of approx. 25,000-30,000m of combined drilling across the two core projects as well as at three or four partner-funded projects.

According to a report from Peter Epstein at Epstein Research, "Management is focusing the majority of its largest-ever drill program at Russell. If meaningful discoveries are made at Russell or ML, that would draw a lot of attention to the story. Either as satellite deposits for a nearby mill or a standalone mine — sizable high-grade endowments would be mined."

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE)

Management owns some 5% of the company. According to Reuters, CEO Trimble owns 1.8%, with 2.68 million shares. Director David Cates owns 0.84%, with 1.25 million. Mr. Cates is also the President and CEO of Denison Mines, a larger uranium developer that is a strategic partner and shareholder of Skyharbour Resources.

Alps Advisors, Inc. is the largest institutional shareholder, owning 5.65%, with 8.39 million shares. Mirae Asset Global Investments (USA) LLC has 4.45%, with 6.61 million. Exchange Traded Concepts, LLC has 2.85%, with 4.24 million. MMCAP Asset Management has 2.46%, with 3.66 million. Sprott Asset Management LP has 0.89%, with 1.32 million. DWS Investment GmbH has 0.40%, with 0.6 million, and Vident Investment Advisory, LLC has 0.35%, with 0.52 million shares.

Skyharbour has other institutional buy-in from Extract Capital, Sachem Cove, L2 Capital Partners, Sprott Capital Partners LP, and OTP Fund Management.

Strategic investors include Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT), Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK), Jeff Phillips, and Paul Matysek, founder and former President/CEO of Energy Metals Corp., which grew from a market cap of US$10 million in 2004 to approximately US$1.8 billion when it was acquired by Uranium One Inc. (UUU:TSX) in 2007.

The rest is retail.

The company has a market cap of CA$54.9 million, with 148.5 million shares, 25.9 million warrants, and 10.8 million options outstanding, for a fully-diluted base of 185.3 million.

Skyharbour has some CA$6 million in the bank, with another CA$2 million in option partner payments expected over the next 12 months. Its monthly burn rate is approx. CA$125,000

Two major analysts are currently covering the firm; Siddarth Rajeev of Fundamental Research Corp. and David Talbot of Red Cloud Securities Inc. Newsletters INN, Equity Guru, Peter Epstein, and Energy & Gold Ltd. also track the company.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Owen Ferguson wrote this article for Streetwise Reports LLC, and provides services to Streetwise Reports as an independent contractor. They or members of their household own securities of the following companies mentioned in the article: None. They or members of their household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Skyharbour Resources Ltd. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Skyharbour Resources Ltd., a company mentioned in this article.