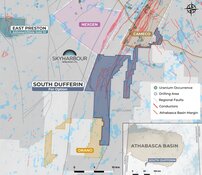

Skyharbour Resources Ltd.'s (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) partner company Azincourt Energy has announced that the sample analysis has been received from the 2023 exploration program at the East Preston uranium project in the Athabasca Basin, in Saskatchewan, Canada. Azincourt is the operator and majority interest holder in the project with Skyharbour holding a minority interest.

Drilling for the 2023 program at the East Preston Project consisted of a total of 3,066m completed in 13 drill holes. Drilling was focused on the G, K, H, and Q zones, with a drilling update reported in a news release dated March 28, 2023.

There are several highlights from the Winter 2023 Diamond Drilling Program, as a total of 687 samples were collected throughout the program. Analysis of the results shows uranium enrichment within the previously identified clay alteration zones along the K and H target zones. Uranium enrichment is identified as uranium (U) values and a uranium/thorium ratio (U/Th) above what would normally be expected in the given rock type or area.

Drilling on the northeast-trending G-Zone identified extensive hydrothermal alteration and evidence of east-west cross-cutting structures along the southern portion of the zone. The primary rock types in the alteration zone are granodiorite and diorite gneiss, with average expected values of 2-3 ppm U and U/Th ratios of 0.25-0.3. Elevated radioactivity was intersected in holes EP0045 and EP0047, and EP0047 returned elevated U and U/Th values.

Fundamental Research analyst Sid Rajeev rated Skyharbour a Buy, with a fair value target price of CA$0.97.

While this is a good sign, the alteration zone does not display the upgraded clay alteration halo seen at Zones K and H. Illite, and kaolinite are both indicators of hydrothermal alteration typically found within alteration halos of unconformity uranium deposits.

Dravite is a boron-rich clay that is typically found within a larger clay package in close proximity to uranium mineralization in the system. Both illite and dravite have been identified as being significant vectors for the recent Patterson Lake North discovery by F3 Uranium, approximately 60km to the northwest of the East Preston project.

The report also included highlights from the 2023 target areas and drill hole locations at the East Preston Uranium Project. On the north end of the K-Zone, drilling intersected extensive structure and hydrothermal clay alteration within the structural zone. All three holes contained illite and kaolinite clay types, with hole EP0049 also containing dravite identified within the structural zone. Hole EP0049 also returned elevated Thorium.

The H-Zone covers a change in the orientation of the structural and conductive trend from north-south to southwest trending. Drilling intersected an intense graphitic fault zone with hydrothermal alteration. The illite clay alteration halo identified within the K-Zone extends south into the H-Zone as far south as EP0053. Hole EP0053 intersected elevated radioactivity, and both kaolinite and dravite are also present within the illite alteration package.

In a July newsletter, Technical Analyst Clive Maund also rated Skyharbour as a Buy for investors.

Dravite was also identified in hole EP0052. Rocks in this zone are expected to return values of 0.5-1.5 ppm U and U/Th ratios of 0.25-0.5. Holes EP0052 and EP0056 returned the best analytical results of the program with U/Th ratios of 1.0 and 1.8, respectively, and uranium in the 5-6 ppm range.

According to Azincourt's VP of Exploration, Trevor Perkings, "The alteration we are seeing in the K and H-Zones is very encouraging. The associated elevated uranium present is also very promising and shows that we are vectoring towards something in this area. The identification of dravite and illite clays with the elevated uranium emphasizes that we are on the right track and getting close. This target area will be a top priority moving forward, and based on results, we may see the north-northwest trending structures taking on more significance for targeting on this trend and others on the property."

Tightening Supply Driving Up Price

Reuben Adams with Stockhead notes that the Sprott Physical Uranium Trust (SPUT) could drive up the price of yellowcake uranium. Pounds bought by the trust would be placed in long-term storage, driving down the availability of uranium as a resource and driving up demand.

At present, the trust has over 61.7 million pounds of uranium in storage. Higher prices may incentivize new production, but they may also be an opportunity for investors.

A Solid Buy

In June, Fundamental Research analyst Sid Rajeev rated Skyharbour a Buy, with a fair value target price of CA$0.97. Rajeev noted, "SYH maintains a strong balance sheet. We anticipate several catalysts from the ongoing and planned exploration programs by SYH and its partners this year."

Technical Analyst Clive Maund is also optimistic about the stock. In a July newsletter, he also rated Skyharbour as a Buy for investors.

According to Maund at the time, "On the 5-year chart, we can see why the Head-and-Shoulders bottom has formed where it has- the price is down close to cyclical lows and in a zone of strong support which is clearly a good point for it to turn higher again.

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE)

Management and insiders own 5% of the company.

Jordan P. Trimble owns 1.73% of the company with 2.78 million shares, and David Daniel Cates owns 0.77% with 1.25 million shares.

Alps Advisors, Inc. owns 5.74% with 9.28 million shares, Mirae Asset Global Investments LLC owns 4.63% with 7.48 million shares, Sprott Asset Management LP owns 3.07% with 4.96 million shares, Exchange Traded Concepts, LLC, owns 2.62% with 4.24 million shares, MMCAP Asset Management owns 2.26% with 3.66 million shares, Incrementum AG owns 1.44% with 2.32 million shares, Vident Investment Advisory, LLC, owns 0.38% with 0.61 million shares, and DWS Investment GmbH owns 0.37% with 0.60 million shares.

Skyharbour has two strategic investors, with Denison Mines owning 11.5 million shares and Rio Tinto owning 3.6 million shares.

The company has over CA$4.5 million in the bank with a burn rate of about CA$125k.

There are 169.1 million shares outstanding, with 157.13 free-float traded shares. The company has a market cap of CA$62.6 million. It trades in the 52-week period between CA$0.32 and CA$0.56.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Skyharbour Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.