Revolve Renewable Power Corp. (REVV:TSX; REVVF:OTCQB) develops utility-scale renewable energy projects in North America generated by wind, solar, and battery storage technologies.

The company currently has 2,883 megawatts (MW) of utility-scale projects under active development in the United States and Mexico, with 156 MW in the distributed generation (DG) project pipeline. It has produced more than 1.6 million kilowatt hours (KWh) of energy and sold 1,550 MW of utility-scale projects.

As part of its process of moving from a "pure" development company to becoming an owner and operator and expanding into Canada, the company last fall proposed acquiring Canada-based WindRiver Power Corp. WindRiver is an operator and developer of wind and hydro projects in British Columbia and Alberta.

"We are delighted to reach an agreement for our first acquisition in the Canadian market," Revolve Chief Executive Officer Steve Dalton said. "As we outlined in our updated corporate presentation a number of weeks ago, the acquisition of operating assets is a key part of our strategy to accelerate the transition of the Company to an owner / operator business."

"The acquisition of WindRiver will add long-term recurring revenue and cash flow to the business, accelerate our expansion into the Canadian market, and bring with it a highly experienced operations and development team," Dalton continued.

Once completed, the acquisition will add 96.63 MW (6.63 MW of its net operational) of capacity to Revolve's portfolio.

Push for Clean Energy 'Never Been Stronger'

According to a report by Deloitte Insights on the outlook for renewable energy this year, the sector is "set for a variable-speed takeoff as historic investment, competitiveness, and demand propel their development."

Renewable energy deployment is expected to grow by 17% to 42 GW in 2024 and account for almost a quarter of electricity generation, according to the Energy Information Administration.

"The tandem push of federal investments flowing into clean energy and pull of decarbonization demand from public and private entities have never been stronger," Deloitte wrote. "Moving into 2024, these forces could enable renewables to overcome hurdles caused by the seismic shifts needed to meet the country's climate targets. The uplift and obstacles shaping the year ahead have set the stage for a variable-speed takeoff across renewable technologies, industries, and markets."

Water Tower Research analysts Shawn Severson and Graham Mattison noted in a January 30 research note that the company "trades at a significant discount to its peers."

As many as 29 jurisdictions representing around half of U.S. electricity retail sales have mandatory renewable portfolio standards, Deloitte reported, 24 requiring zero greenhouse gas (GHG) emissions or 100% renewable energy goals between 2030 and 2050.

On the corporate side, the membership in the RE100, a global initiative for entirely renewable energy, has more than 420 members, including 30 that joined in the first ten months of 2023, Deloitte said. A quarter of them are in the U.S., and many have 2025 target dates.

"The impact of unprecedented investment in renewable infrastructure will likely become more apparent in 2024," the report said. "Regulatory boosts to renewable energy and transmission buildout could help address grid constraints. And boosts to manufacturing could lay the foundations of a domestic clean energy industry with stronger supply chains supporting solar, wind, storage, and green hydrogen deployment."

Revolve Trades at Discount to Peers

Revolve noted that it provides investors with "higher development returns from utility-scale project development, balanced by long-term recurring cashflow from distributed generation projects."

The company also has sold 1,550 MW of wind and solar projects, generating close to US$20 million in revenue to date.

The company reported its net income as CA$0.9 million, or CA$0.01 per share, for the first quarter of 2024, compared to a loss of CA$0.6 million, or CA$0.01 per share, in Q1 2023.

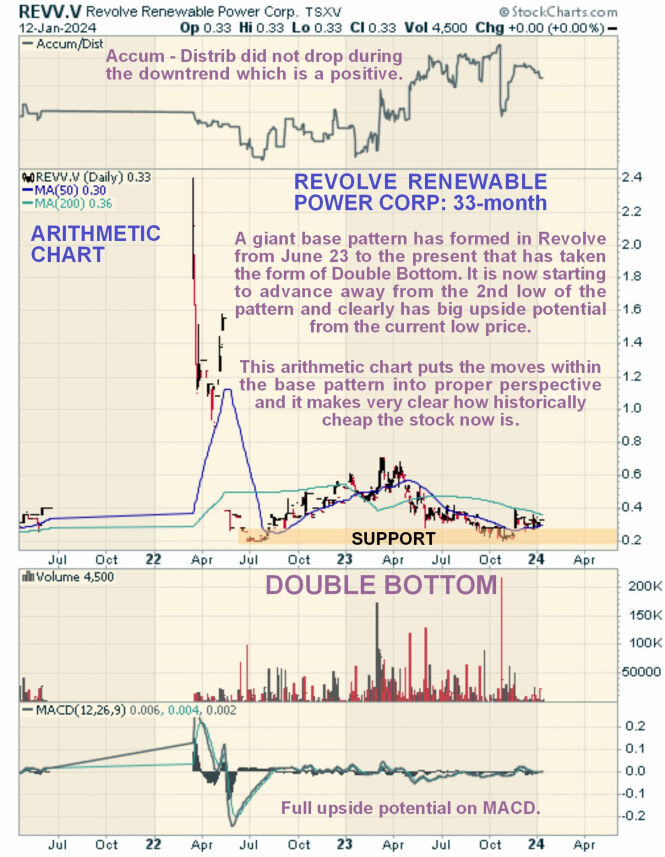

Technical Analyst Clive Maund said it was worth looking at Revolve's 33-month chart "as it 'opens out' the base pattern, enabling us to see what was going on within it in more detail."

Water Tower Research analysts Shawn Severson and Graham Mattison noted in a January 30 research note that the company "trades at a significant discount to its peers," which included Westbridge Renewable Energy Corp. with a share price of CA$1.01 on January 24 compared to REVV's CA$0.32; and Greenbriar Sustainable Living Inc., which was CA$0.82 per share on the same day.

"(REVV) has delivered revenue and EBITDA, has a larger development pipeline than many of its peers, and further expected payments," the analysts said.

Westbridge's market cap was CA$100.3 million, while REVV's was CA$17.17 million. Greenbriar's was CA$28 million.

However, Dalton said it's companies like Polaris Renewable Energy Inc. that the company is reaching toward. Polaris has a market of about CA$271 million.

"They're the type of companies I'm looking towards to see what they're doing," Dalton said.

The Catalysts: New Projects, Earnings

A catalyst expected for the company includes the closing of the WindRiver deal, which was expected in December but is now expected soon.

Revolve also expects to realize more DG projects, like its signed Power Purchase Agreement (PPA) for a new 450 kWp rooftop solar project in Mexico.

The company's Q2 2024 results are also expected at the end of February.

Technical Analyst Clive Maund said it was worth looking at Revolve's 33-month chart "as it 'opens out' the base pattern, enabling us to see what was going on within it in more detail."

"This log chart makes clear that even though the price was still within the base pattern, the percentage price swings within it were sizeable — it more than tripled in price on the uptrend from the first low of the Double Bottom before losing it all again as it drifted down to form the second low of the Double Bottom," Maund wrote.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Revolve Renewable Power Corp. (TSXV:REVV;OTCQB:REVVF)

On Revolve's 13-month chart, the price "broke sharply and decisively" out of a downtrend in November, and "another sharp upleg is to be expected soon that will quickly lead to a bullish cross of the main moving averages," Maund noted.

Ownership and Share Structure

About 60% of the company is owned by insiders and management, Revolve said.

Top shareholders include Joseph O'Farrell with 13.58%, Roger Norwich with 12.49%, the CEO and Director Stephen Dalton with 5.96%, President and Director Omar Bojoquez with 4.95%, and Jonathan Clare with 1.9%.

The rest is retail.

Revolve has a market cap of CA$17.17 million with 61.32 million shares outstanding and 36.36 million free floating. It trades in a 52-week range of CA$0.71 and CA$0.20.

| Want to be the first to know about interesting Renewable - Solar, Clean Energy and Renewable - Wind investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Renewable Power Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Revolve Renewable Power Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for Water Tower Research, Jan. 30, 2024:

Water Tower Research ("WTR") is a professional publisher of investment research reports on public companies and, to a lesser extent, private firms ("the Companies"). WTR provides investor-focused content and digital distribution strategies designed to help companies communicate with investors.

WTR is not a registered investment adviser or a broker/dealer nor does WTR provide investment banking services.

WTR operates as an exempt investment adviser under the so called "publishers' exemption" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940. WTR does not provide investment ratings/recommendations or price targets on the companies it reports on. Readers are advised that the research reports are published and provided solely for informational purposes and should not be construed as an offer to sell or the solicitation of an offer to buy securities or the rendering of investment advice. The information provided in this report should not be construed in any manner whatsoever as personalized advice. All users and readers of WTR's reports are cautioned to consult their own independent financial, tax and legal advisors prior to purchasing or selling securities.

The analyst who is principally responsible for the content of this report has represented that neither he/she nor members of his/her household have personal or business-related relationships to the subject company other than providing digital content and any ancillary services that WTR may offer.

Unless otherwise indicated, WTR intends to provide continuing coverage of the covered companies. WTR will notify its readers through website postings or other appropriate means if WTR determines to terminate coverage of any of the companies covered.

WTR is being compensated for its research by the company which is the subject of this report. WTR may receive up to $14,000 per month [for research and potentially other services] from a given client and is required to have at least a 1-year commitment. None of the earned fees are contingent on, and WTR's client agreements are not cancellable for the content of its reports. WTR does not accept any compensation in the form of warrants or stock options or other equity instruments that could increase in value based on positive coverage in its reports.

WTR or an affiliate may seek to receive compensation for non-research services to covered companies, such as charges for presenting at sponsored investor conferences, distributing press releases, advising on investor relations and broader corporate communications and public relations strategies as well as performing certain other related services ("Ancillary Services"). The companies that WTR covers in our research are not required to purchase or use Ancillary Services that WTR or an affiliate might offer to clients.

The manner of WTR's potential research compensation and Ancillary Services to covered companies raise actual and perceived conflicts of interest. WTR is committed to manage those conflicts to protect its reputation and the objectivity of employees/analysts by adhering to strictly-written compliance guidelines.

The views and analyses included in our research reports are based on current public information that we consider to be reliable, but no representation or warranty, expressed or implied, is made as to their accuracy, completeness, timeliness, or correctness. Neither we nor our analysts, directors, officers, employees, representatives, independent contractors, agents or affiliate shall be liable for any omissions, errors or inaccuracies, regardless of cause, foreseeability or the lack of timeliness of, or any delay or interruptions in the transmission of our reports to content users. This lack of liability extends to direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, losses, lost income, lost profit or opportunity costs.

All investment information contained herein should be independently verified by the reader or user of this report. For additional information, all readers of this report are encouraged to visit WTR's website www.watertowerresearch.com.