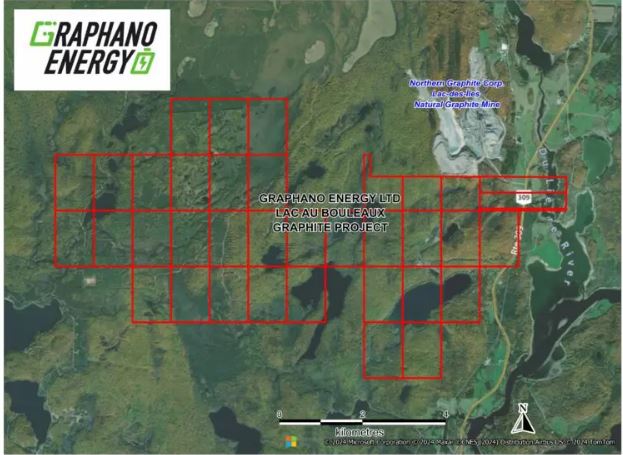

Graphano Energy Ltd. (GEL:TSXV; GELEF:OTCMKTS) staked 20 more, largely unexplored mining claims on the western side of its Lac-Aux-Bouleaux (LAB) project in southern Quebec, Canada, thereby more than doubling its holdings there, as announced in a news release.

"Our exploration results at the LAB project have been very promising, reinforcing our commitment to expanding our footprint in this region," Chief Executive Officer Luisa Moreno said in the release.

These additional claims at LAB, spanning 1,187 hectares (1,187 ha), take the total claims at the project to 36, covering 2,028 ha, the release noted. The stratigraphy and geology of these claims are similar to those of the original LAB claims and of Northern Graphite Corp.'s (NGC:TSX.V; NGPHF:OTCQX) near Lac des Iles project in Ontario, North America's only producing graphite mine.

Graphite Pure Play

Headquartered in Vancouver, BC, Graphano Energy is a mining exploration company focused on graphite, a mineral considered critical by most major economies, including the U.S., Canada, the European Union, India, and China. The company boasts three projects in Quebec, LAB being the flagship.

"Overall, we believe the project is promising based on historical work/resource, favorable metallurgical results, and proximity to Canada's only graphite producer," Fundamental Research Corp.'s Head Analyst Sid Rajeev wrote in a 2022 initiation report. "Management is aiming to advance the project to commercial production."

A move the U.S. made earlier this year "is going to make the product of North American producers a lot more competitive and attractive," Technical Analyst Clive Maund wrote in a May 28 report on Graphano.*

The federal government imposed a 25% tariff on natural graphite coming from China to begin in 2026. Also, since last October, China has been tightening exports of the mineral to the States and other countries, significant because it is the world's the top graphite producer and exporter.

It is estimated that China will produce 77% of all the natural graphite produced globally this year, according to Benchmark Mineral Intelligence.

Graphano's LAB is in an area actively mined for natural graphite historically. Since the project was discovered in 1957, several companies have explored and mined it. The historical resource is 1,320,000 tons of 9% graphite carbon (Cg). While small in terms of tonnage, Rajeev pointed out, the grade exceeds the 6% grade of comparable projects. A higher grade suggests the potential for a lower operating expense and a higher annual production at LAB.

"We believe Graphano will be a likely M&A target if it is able to prove up, or at least confirm, the historic resource," wrote the analyst.

Another past-producing project of Graphano is Standard. At this property in winter 2023, the company drilled the Eastern Trend and extended the strike length by 250 meters (250m). One of the four holes drilled returned 6.09% Cg over 13.06m. Mineralization was shown to remain open in the strike and dip directions.

Now at LAB and Standard, a spring-summer exploration program is in progress, having commenced in mid-April. Work being done includes prospecting, trenching, and stripping of areas with graphite outcrops, all with the goal of identifying new drill targets.

With this campaign at LAB, Graphano is targeting the new claims and the property zones that have not been extensively examined, notably 2, 5, and 6. The area of concentration at Standard is the additional 79 claims Graphano staked in March, sitting between this project and the Mousseau project to the east, with measured resources.

Earlier this month, metallurgical test results on composite samples of drill core from LAB and Standard came back positive, the company announced. At LAB, for instance, one sample yielded a concentrate grade of 95% Cg in several particle-size fractions, and 70% open-circuit graphite recovery was achieved, with potential for more than 90% recovery at closed circuit. At Standard, one sample produced a graphite concentrate grading 94% Cg at 93% recovery.

Graphano's Dudley and Lac Vert-Bouthillier graphite showings, are 5 and 10 kilometers south of LAB, respectively, and encompassing 11 claims over 600 ha.

Demand For Critical Mineral To Soar

Graphite is primarily used in lithium batteries, brake linings, lubricants, powdered metals, refractory applications, and steelmaking. Consumption of this mineral is projected to continue its upward trend since 2019, the U.S. Geological Survey wrote in a 2024 mineral commodity summary.

This in large part is due to market growth of lithium-ion batteries for use in electric vehicles, or EVs, (one EV battery contains 40–60 kilograms of graphite material) and stationary energy storage devices. Demand from the battery sector alone is expected to increase 250% between 2023 and 2030, according to Benchmark Mineral Intelligence.

An April article out of the University of California−Davis' Institute of Transportation Studies asserted that "graphite demand will soar in the decade ahead." Between 2022 and 2035, the period of study, total global graphite demand will reach 7,334 kilotons, more than quadruple the amount in 2022, the authors forecasted. Such an upswing represents an 11.6% compound annual growth rate. During the same window, they projected, demand related to lithium-ion batteries will hit 78%, up from 36%.

Rising graphite demand is squeezing existing supply and value chains, they wrote. "Global reserves and ore quality of natural graphite are high, but mining operations are not well-developed in all locations with mineral deposits," the authors added.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Graphano Energy Ltd (GEL:TSXV;GELEF:OTCMKTS)

The Catalyst: Delineation Of New Targets

In the near term, investors should watch for the results of Graphano's in-progress exploration program at LAB and Standard.

Ownership and Share Structure

According to the company, about 15% is owned by insiders and management, 3.5% is owned by institutions, and the rest is retail.

According to Reuters, as of June 17, Michael Bauer owns 10.05% or 1.72 million shares, Director Nathan Rothstein owns 6.94% or 1.19 million shares, Chief Financial Officer James A. Richardson owns 0.46% or 0.08 million shares, Director Roger Dahn owns 0.20% or 0.03 million shares, and Moreno owns 0.20% or 0.03 million shares.

The company has 17.09 million shares outstanding, including 14.03 million free-float traded shares. It has a market cap of CA$1.71 million and trades in a 52-week range of CA$0.25 and CA$0.09.

| Want to be the first to know about interesting Battery Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the Clive Maund article published on May 28, 2024

- For the quoted article (published on May 28, 2024), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500 in addition to the monthly consulting fee.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.