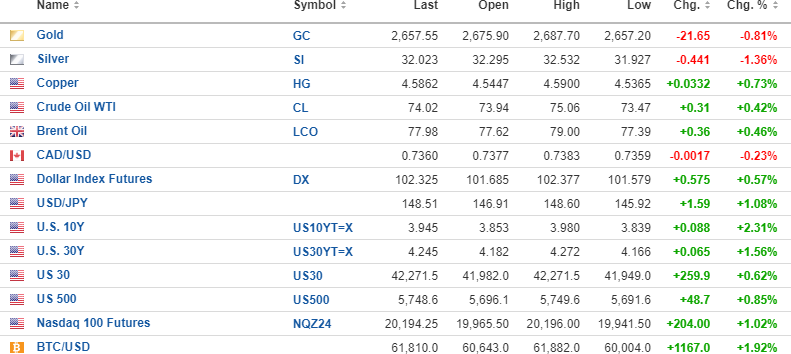

The NFP "jobs" report came in hotter than the estimates (257k vs. 140k est.), taking USD index futures down 0.15% this morning, with the 10-year and 30-year yields also up 0.34% and 0.28%, respectively.

Gold fell 0.81% (-$21.65) along with silver down $0.44 (-1.36%) as well.

Oil (+0.42%) is ahead, $0.31/bbl to $74.02/bbl, and copper (+0.73%) is also ahead.

Equity futures are up sharply (+0.62% to + 1.56%), and risk barometer Bitcoin is down 1.92% to $61,810.

Stocks

The employment report has thrown a bid into the equity markets as a knee-jerk reaction to stronger job growth, but if stocks rallied due to the 50-b.p. rate cute by the Fed, these better-than-expected report certainly dulls the odds of another 50-point cut in November.

In fact, these numbers suggest that there will be no cut at all in November as wages rose and the unemployment rate dropped, which is not what the Fed wants to see now that they have declared inflation "under control."

I own the 2x Long VIX Futures ETF (VIX:INDEXCBOE) at $4.73 and after closing at $5.70, it is expected to open at $5.45.

I maintain that stocks are going to be under pressure until at least the third week of October so I will hold my egregiously-large position in this volatility trade.

Subscribers that have yet to take down a position might look to add into weakness this morning.

Oil

Crude oil prices continue to advance and are now approaching $75/bbl.

The RSI for WTIC is still only 58.58, so there is a lot of room for this to advance to the 200-DMA at $77.19/bbl.

As for the Energy Select Sector SPDR Fund (XLE:NYSEARC), it tracks crude, so if I am correct in my call on crude oil, the producers will still have a long way to move.

The big investment pools are still not positioned in energy as they are underweight massively, while the hedge funds are net short, setting up the potential for a squeeze before the end of the month.

Furthermore, with the IDF targeting the Iranian oil infrastructure, any sudden supply shock, even if only implied, will send the shorts scurrying.

Hence, while I wish I had put this trade on when I loaded up on the ETF:

- BUY 10 calls XLE December $90 at $6.50 Target: $15 by expiry.

| Want to be the first to know about interesting Oil & Gas - Exploration & Production investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.