Skyharbour Resources Ltd.'s (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) partner company Medaro Mining Corp. (MEDA:CNX) has announced its exploration plans for the winter at its Yurchison uranium property in Saskatchewan.

Beginning in the next 45 days, Medaro plans to start geological prospecting, mapping and sampling of the various rock types located on the property, aided by ground radiometric surveying using hand-held gamma-ray spectrometers and scintillometers.

Medaro said its primary goal is to determine the hose rock and/or structural control of previous identified radioactive mineral occurrences, explain the surficial expression (if any) of the VTEM conductors, and locate additional zones of uranium mineralization and/or radioactivity along prospective zones.

"Our earlier exploration work, including the discovery of uranium indicators, has provided us with targets and (we) look to expand on them," said Medaro Chief Executive Officer Michael Mulberry. "This program represents a critical next step in advancing the project as we work towards unlocking its full potential. The Athabasca basin region is known for its rich mineral resources, and we are optimistic about the opportunities that lie ahead."

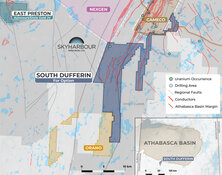

Skyharbour has an extensive portfolio of uranium exploration projects in Canada's Athabasca Basin, with 29 projects, 10 of which are drill-ready, covering over 580,000 hectares of mineral claims. In addition to being a high-grade uranium exploration company, it also utilizes a prospect generator strategy by bringing in partner companies such as Medaro to advance secondary assets.

Analyst Sid Rajeev of Fundamental Research Corp. has written that Skyharbour "owns one of the largest portfolios among uranium juniors in the Athabasca Basin."

"Given the highly vulnerable uranium supply chain, we anticipate continued consolidation within the sector," wrote Rajeev, who gave the stock a Buy rating with a fair value estimate of CA$1.21 per share. "Additionally, the rapidly growing demand for energy from the AI industry is likely to accelerate the adoption of nuclear power, which should, in turn, spotlight uranium juniors in the coming months."

Other Skyharbour partner companies include Orano Canada, Thunderbird Resources Ltd. (THB:ASX) (Previously Valor Resources Ltd.), Basin Uranium Corp. (NCLR:CSE; BURCF:OTC; 6NP0:FRA), Terra Clean Energy Corp. (TCEC:CSE; TCEFF:OTC; T1KC:FSE) (Formerly Tisdale Clean Energy Corp.), North Shore Uranium Ltd. (NSU:TSX), and UraEx Resources.

A Good Neighborhood

The Yurchison property is about 95 kilometers south of Cameco Corp.'s (CCO:TSX; CCJ:NYSE) Rabbit Lake and Denison Mines Corp.'s (DML:TSX; DNN:NYSE.MKT) McClean Lake uranium mines, along the southeastern boundary of the Athabasca basin. It's accessible by an all-weather highway that runs through the middle of the property. Access to the southwest and northeast areas of the property are by helicopter.

Medaro said historical prospecting near old trenches returned significant uranium (ranging from 0.09% to 0.30% triuranium octoxide) and molybdenum (ranging from 2,500 parts per million [ppm] to 6,400 ppm) mineralization in both outcrop and float samples.

"Two historical holes drilled beneath the trenches returned highly anomalous molybdenum values, up to 3,750 ppm, and anomalous uranium values, up to 240 ppm," the release said. "The property boasts strong discovery potential for both basement-hosted uranium mineralization, as well as copper, zinc and molybdenum mineralization."

As part of its option agreement with Skyharbour, Medaro can acquire an initial 70% interest in the property by issuing CA$3 million in shares, making aggregate cash payments of $800,000, and incurring CA$5 million in exploration costs on the property over three years.

Medaro may acquire the remaining 30% interest in the property within 30 business days of earning the initial 70% interest by issuing shares worth CA$7.5-million and making a cash payment of CA$7.5 million.

Skyharbour said it will retain a net smelter royalty (NSR) of 2% on 11 of the 12 claims with Medaro holding a buyback option whereby Medaro can purchase 1% of the NSR for CA$1 million. A separate NSR of 2% on the other claim is payable to a third party.

The Catalysts: Powering EVs, AI

The commodity's price has softened this year after peaking at US$100.25 per pound in January, its highest level since 2007. It was US$82 at the end of September.

But a recent research note published by Citi Research predicted any weakness in prices would subside as continued pressure from electric vehicles (EVs) and artificial intelligence (AI) causes the demand for nuclear energy to continue to rise, Investing.com wrote.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE)

"Analysts at Citi remain tactically bullish on uranium in the near to mid-term, with projections indicating a potential price rebound to (US)$98/lb later this year," the site said. "Citi has adjusted its uranium price forecasts in response to the recent market softness. The analysts now expect uranium prices to average (US)$94/lb in 2024, with potential upside momentum during the third and fourth quarters.

Looking further ahead, the website said Citi forecasts uranium prices to average (US)$110 per pound in 2025, reflecting continued bullish sentiment driven by the increasing demand for nuclear energy.

Ownership and Share Structure

Management, insiders, and close business associates own approximately 5% of Skyharbour.

According to Reuters, President and CEO Jordan Trimble owns 1.6%, and Director David Cates owns 0.70%.

Institutional, corporate, and strategic investors own approximately 55% of the company. Denison Mines owns 6.3%, Rio Tinto owns 2.0%, Extract Advisors LLC owns 9%, Alps Advisors Inc. owns 9.91%, Mirae Asset Global Investments (U.S.A) L.L.C. owns 6.29%, Sprott Asset Management L.P. owns 1.5%, and Incrementum AG owns 1.18%, Reuters reported.

There are 182.53 million shares outstanding with 177.59 million free float traded shares, while the company has a market cap of CA$78.5 million and trades in a 52-week range of CA$0.31 and CA$0.64.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Skyharbour Resources Ltd. and Terra Clean Energy Corp. are billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, North Shore Uranium Ltd. and Terra Clean Energy Corp. have consulting relationships with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of North Shore Uranium.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.