Terra Clean Energy Corp. (TCEC:CSE; TCEFF:OTC; T1KC:FSE) is working on developing the Fraser Lakes B Uranium Deposit in the prolific Athabasca Basin in Saskatchewan, Canada, and with an extensive drill program underway this Winter, its stock is believed to have considerable upside potential from its current price and after reviewing its fundamentals we will be looking at the latest stock charts for the company.

NEW YEAR, NEW START — a very important point to make right at the start is that at the beginning of this year, on the second of the month, sweeping management changes were announced by the company, with Mr. Greg Cameron being appointed President and CEO and Mr. C. Trevor Perkins as vice-President exploration, both with immediate effect.

Read the linked article and you will grasp the positive implications of this. Mr Cameron commented, "I'm excited to lead Terra and begin an aggressive development plan of the South Falcon uranium deposit. We believe strongly that our upcoming exploration program will allow us to increase both the size and grade of the current deposit. With renewed optimism in the uranium sector and fresh capital to deploy we believe the timing is right to create a lot of value."

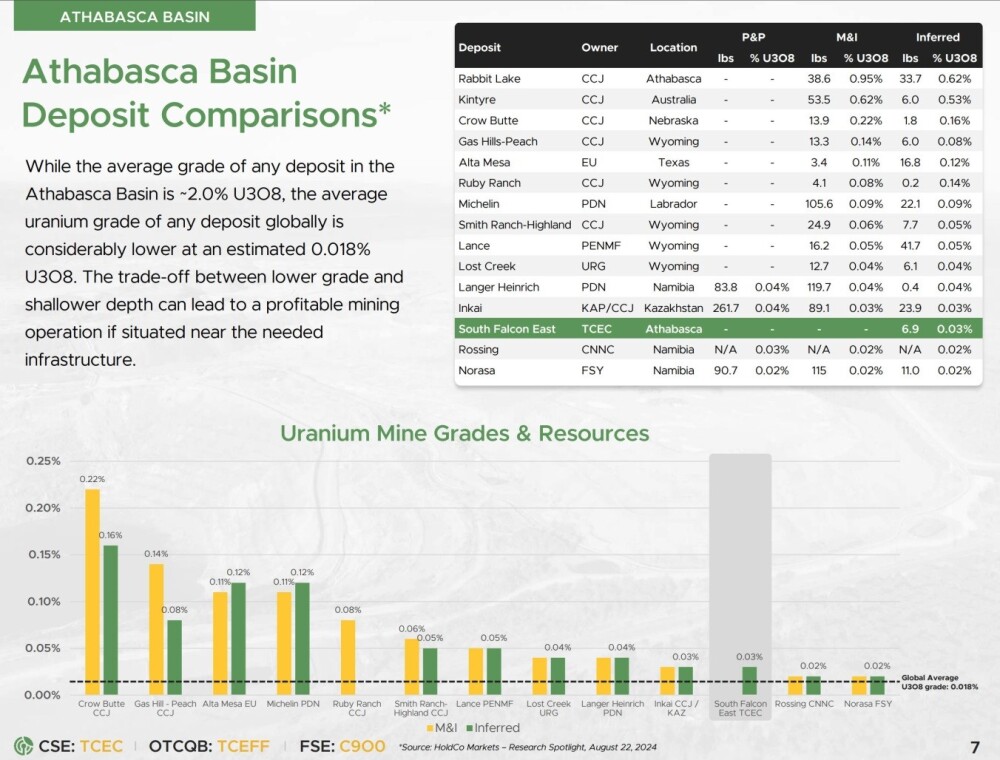

Although Terra's discovered deposits in the Athabasca may be considered to be low grade to date by the standards of the basin, against this we must set the fact that they are at shallow depth and close to infrastructure, thus making them more economic to mine and in any case the ongoing exploration and very considerable exploration potential of the property will likely increase both the grade and the magnitude of the resource going forward.

We will now overview the fundamentals of the company and its assets using pages from the latest investor deck, which is new out this month.

This page overviews the company — a very important point is the ability to develop a shallow near-surface deposit which clearly will have an important positive bearing on costs and, as mentioned above, the possibility of discovering significantly higher grades is ever present.

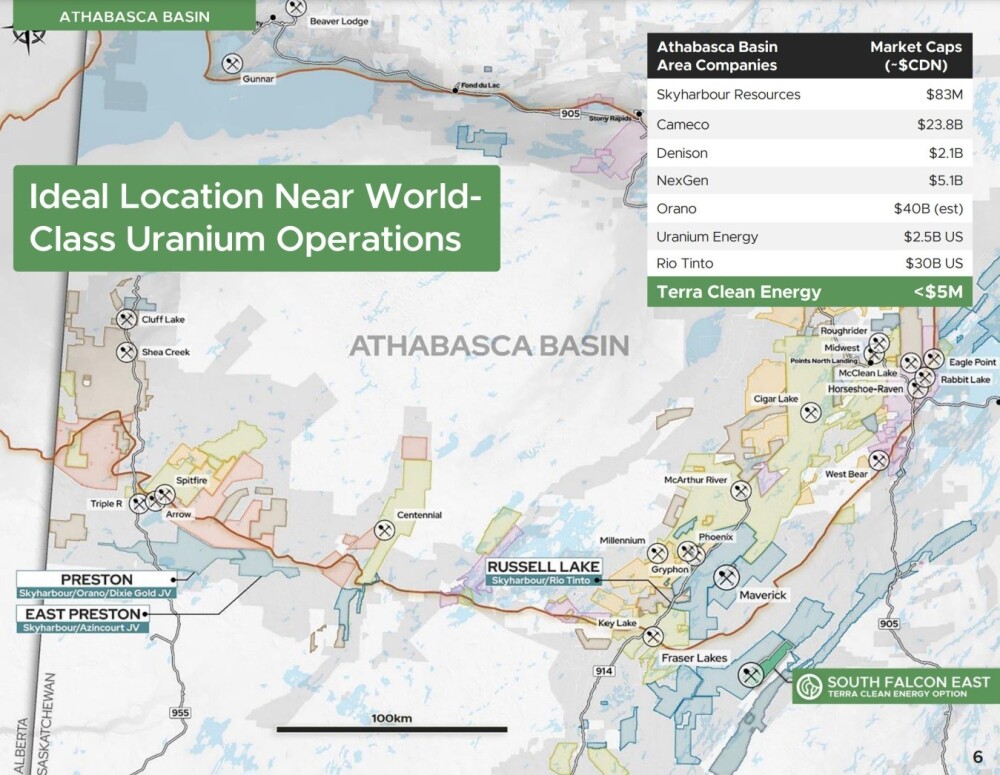

The Athabasca Basin is the best place in the world to explore for uranium.

The following page shows the location of the company's South Falcon East property to the SE of the Athabasca Basin and where it sits relative to other world-class uranium operations nearby, including those operated by the likes of Cameco Corp. (CCO:TSX; CCJ:NYSE) and Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT).

Whilst the grades found so far may not look impressive by the standards of the basin they are considerably higher than the global average, with the shallow depth of deposits found so far a major advantage.

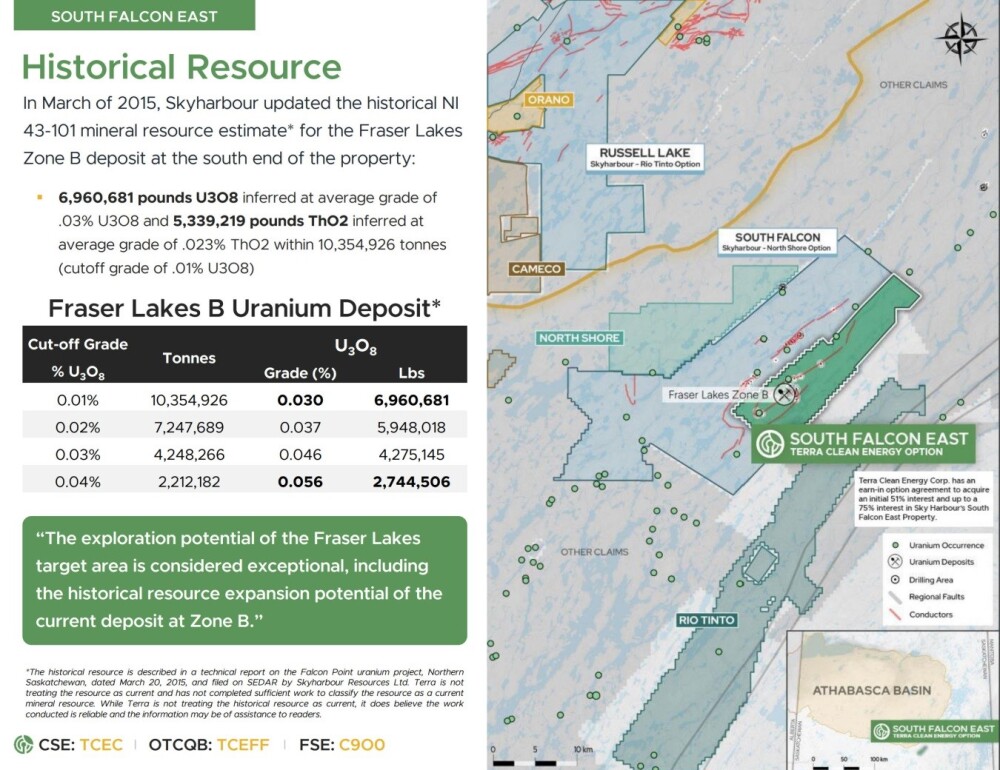

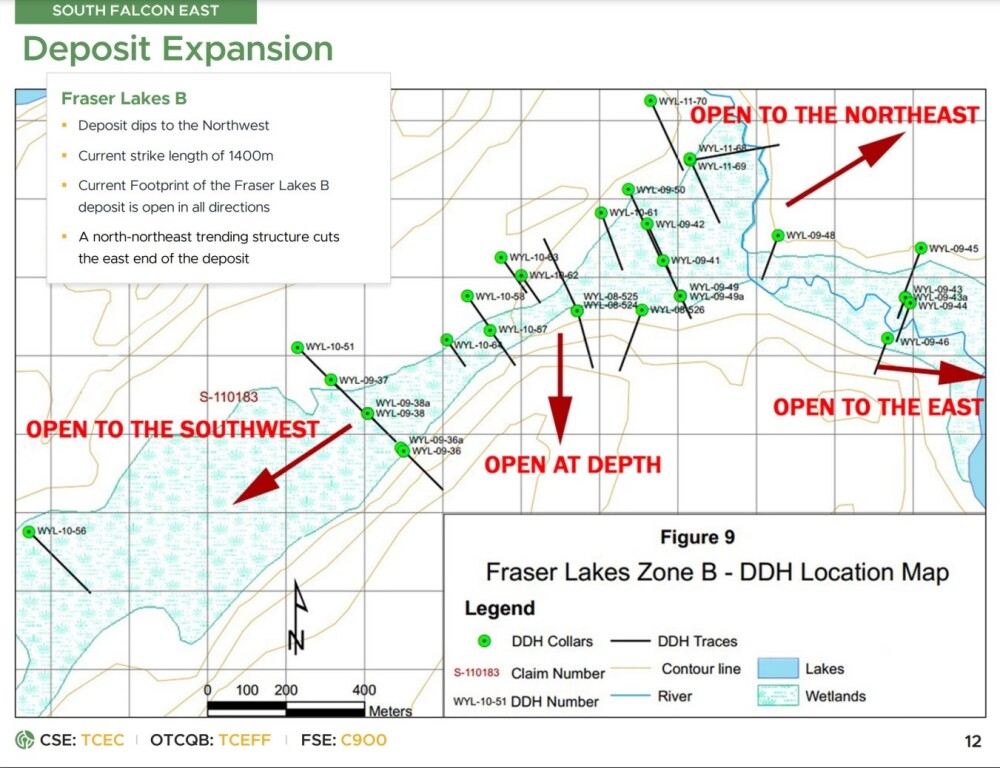

The next page provides a map of the property and a table showing the resource already defined at Fraser Lakes B by an NI-43 – 101 MRE conducted by Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) in 2015.

There is plenty of room in many directions for expansion of the deposit.

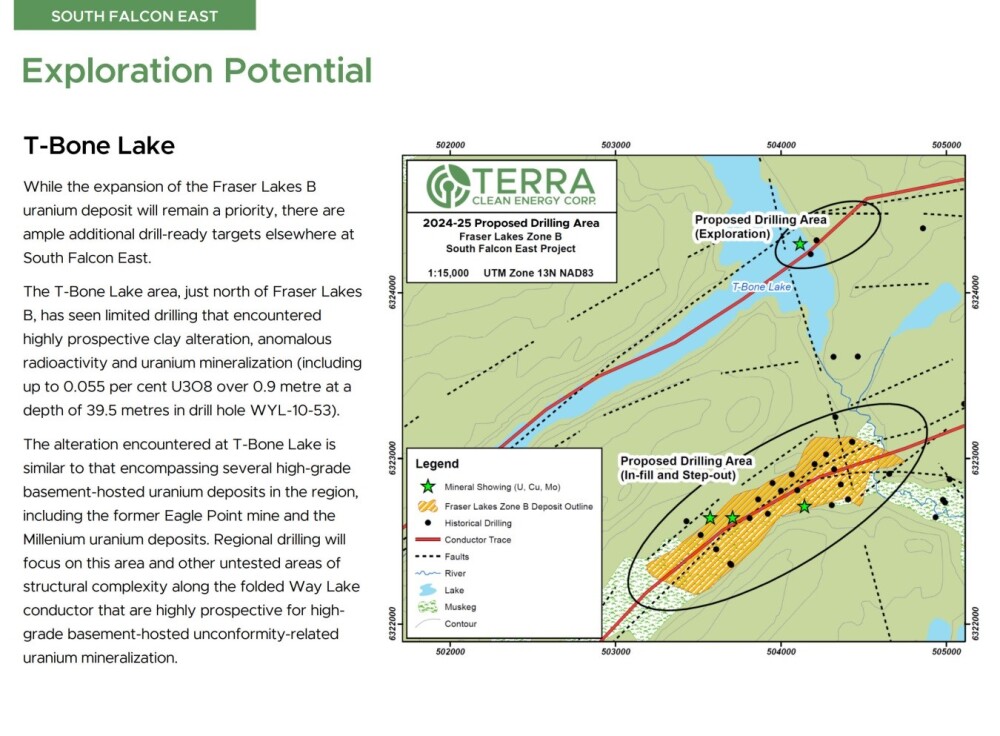

There are other areas of the property apart from Fraser Lakes B with considerable discovery potential, such as T-bone Lake.

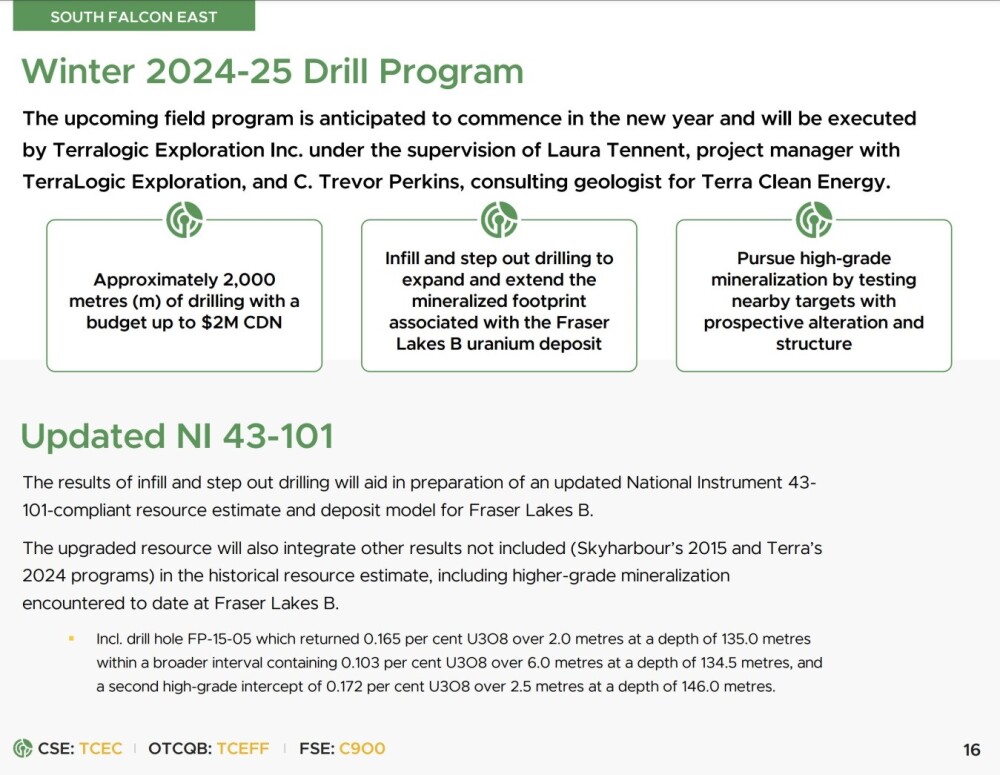

The extensive Winter drill program now underway will contribute to an updated NI-43-101 MRE.

For details of the geology of the property, please refer to the new investor deck linked above.

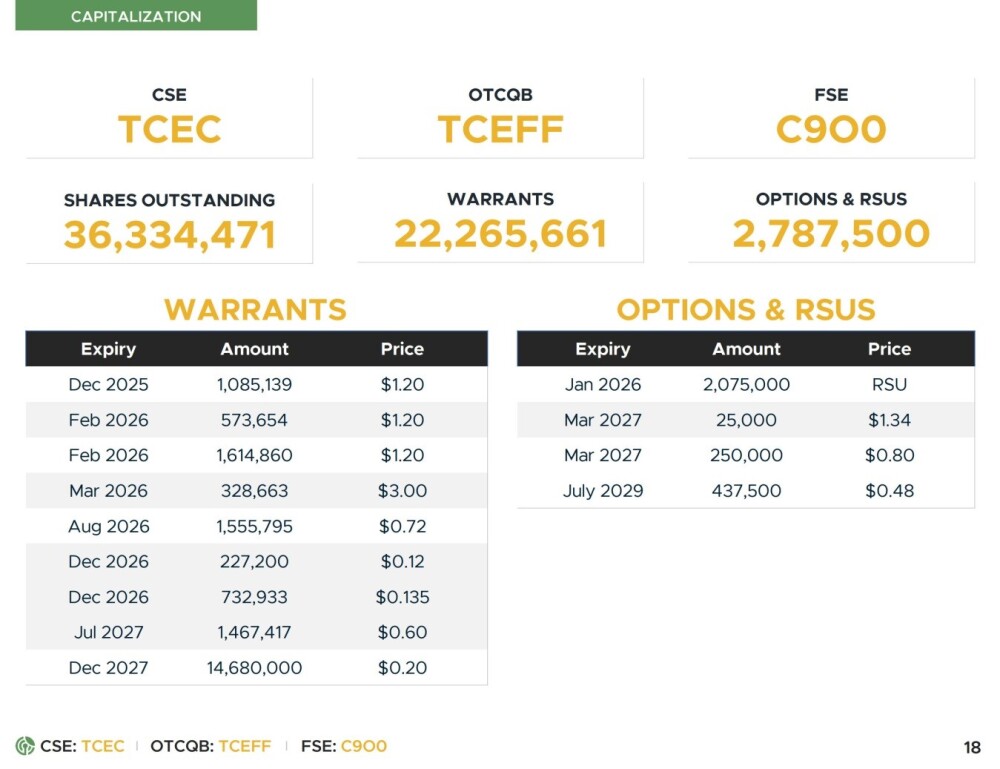

The following table sets out the capitalization details and shows that there are a modest 36.3 million shares in issue.

On the 3-year chart, we can see that Terra Clean Energy remained in a bear market all through 2024, although the rate of decline slowed as the year wore on so that by the end of the year, downside momentum had all but totally dropped out.

This bear market is now looking very "long in the tooth" and like it has run its course, especially given the improving fundamentals with new, experienced management and a robust drilling program underway, and the prospect of a developing bull market in uranium. It is thus suspected that the stock has come to the end of the slower 3rd wave of an A-B-C decline, a view that is supported by the marked positive divergence of the Accumulation line and downside momentum having dropped out. The curved downtrend also shows some convergence, which is bullish.

Zooming in via the 1-year chart enables us to view the C-wave of the bear market in much more detail and in its entirety, and on it, we can see how the decline has been gradually decelerating, and we can also see how, even though moving averages remain in bearish alignment for now, the falling 200-day has been catching up to the price, and this increased bunching of price and moving averages is a frequent precursor to a reversal.

It is thus interesting to observe on a 3-month chart that a small Cup & Handle base appears to have formed since late October with the chances of this being a genuine base pattern improved by the Accumulation line and momentum (MACD) trending higher since November and the existence of an embedded Double Bottom near to its lows as shown.

For both fundamental and technical reasons, it thus looks likely that Terra Clean Energy will break higher into a new bull market soon, and it is rated an Immediate Strong Buy for all time horizons.

Terra Clean Energy's website.

Terra Clean Energy Corp. (TCEC:CSE; TCEFF:OTC; T1KC:FSE) closed for trading at CA$0.205, US$0.1539 on January 13, 2025.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Skyharbour Resources Ltd. and Terra Clean Energy Corp. are billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, Terra Clean Energy Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Terra Clean Energy Corp. and Cameco Corp.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.