Introduction: Breakout Confirmed, A New Upside in Motion

With gold prices making all-time has never been higher highs and lithium prices appearing to have put in a bottom after a ~three-year decline, Lion Rock Resources (ROAR:TSX) is emerging as a standout junior exploration company.

The technical breakout on March 7, 2025, marks a major shift in momentum, signaling significant upside potential in the coming months.

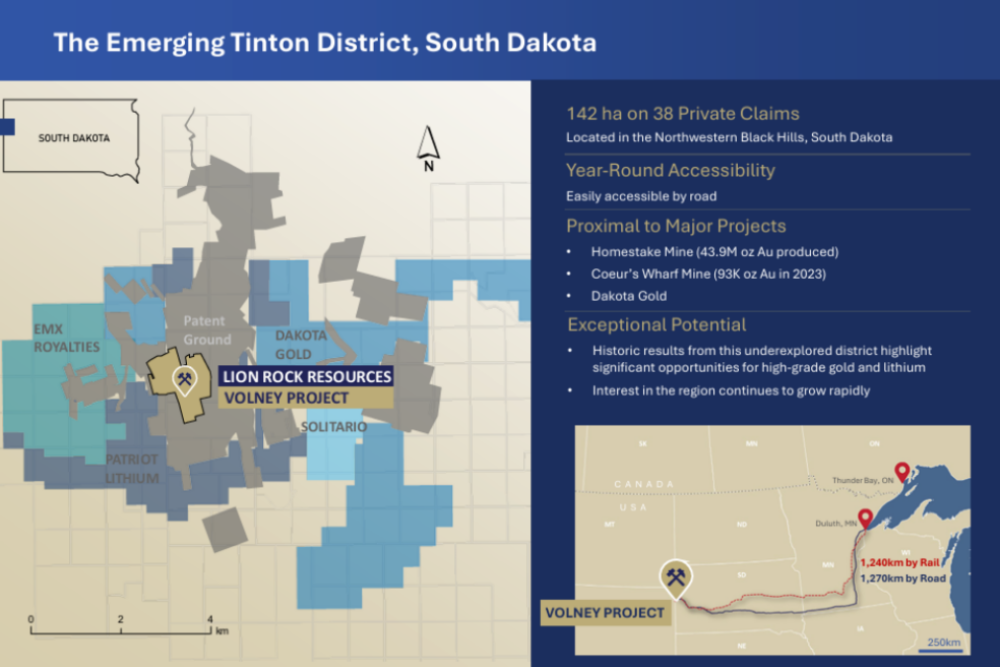

At the same time, the company has secured $2.185 million in new financing, ensuring it has the capital needed to aggressively advance its Volney Gold-Lithium Project in South Dakota's Tinton District, one of North America's most exciting emerging mining regions.

Technical Analysis of Lion Rock Resources (ROAR.V)

The chart for Lion Rock Resources (ROAR.V) confirms a significant technical breakout after a prolonged period of consolidation. The stock had been trading in a tight range, forming a series of higher lows, which is a classic indication of an emerging uptrend. The breakout level occurred at ~$0.20, as price action pushed through the descending trendline resistance, confirming the bullish move.

The Point of Recognition (POR), a key internal resistance level identified by John Newell, sits at approximately $0.30. Once the price surpasses this level, a strong rally could unfold toward the next upside targets. The volume spike accompanying the breakout further strengthens the case for a sustained move higher.

Key Technical Levels and Targets

The stock has established a strong support base at $0.15, which has been repeatedly tested and held firm. With the breakout confirmed, the initial resistance level at $0.20 has been breached, turning it into new support. The next key resistance zone is at $0.30 (POR level), which, once cleared, is expected to accelerate the uptrend toward higher price targets.

If momentum continues, the next major upside level is $0.65, a price last seen in mid-2022. A sustained rally, backed by positive fundamental developments, could see ROAR.V retest its multi-year highs at $1.50. The breakout structure suggests a well-defined technical path toward these targets.

Momentum Indicators Confirm Strength

The MACD (Moving Average Convergence Divergence) indicator has turned positive, with the MACD line crossing above the signal line, confirming bullish momentum. This suggests that buying pressure is increasing, supporting further price appreciation.

The Relative Strength Index (RSI) is currently around 59, approaching overbought territory but still within a healthy uptrend range. If the RSI pushes above 70, it may indicate a short-term consolidation before the next move higher.

A notable increase in volume accompanied the breakout, reinforcing strong participation from traders and investors. Sustained volume above historical averages is crucial for follow-through price action and signals growing market interest in the stock.

This breakout is structurally strong, supported by increased volume, expanding momentum, and a well-defined ascending base. The $0.30 POR level is the next critical resistance, and clearing this point could unlock significant upside potential toward $0.65 and beyond.

Fundamentals Align with Technical Strength

Beyond the technical breakout, Lion Rock's fundamentals are strengthening, further increasing confidence in the potential for a sustained move higher.

On February 6, 2025, Lion Rock closed a $2.16M private placement at $0.10 per unit, with each unit including a warrant at $0.20 (expiring 2027). This financing ensures Lion Rock has the capital to execute a major drill program at the Volney Gold-Lithium Project, allowing for aggressive exploration in the coming months.

The company is preparing to launch a 5,000m drill program in Q1–Q2 2025, focusing on expanding high-grade gold at the Rusty Shaft, testing lithium-rich pegmatites at Giant Volney, and following up on newly identified targets. A successful drill season, with potentially strong results expected in Q2 2025, could significantly re-rate the stock and attract further investor interest.

South Dakota: A World-Class Gold & Lithium District

Lion Rock's flagship Volney Project is located in the Black Hills of South Dakota, an area with over 60 million ounces of historical gold production. The region is known for its rich mineral potential, and Lion Rock is well-positioned to capitalize on both gold and lithium exploration.

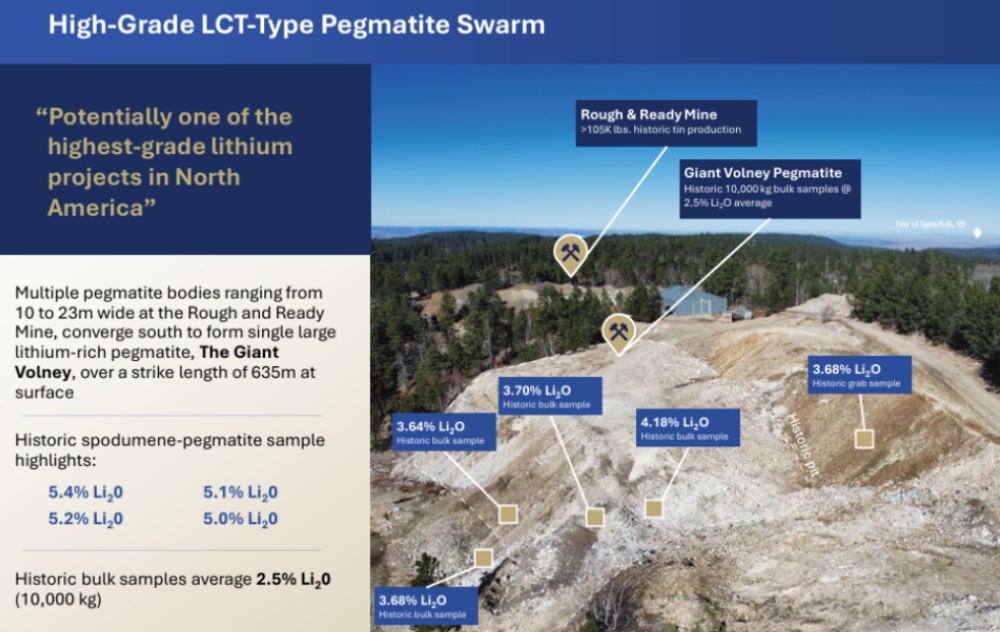

The project has historically delivered high-grade results. Historic channel sampling returned 18.2 g/t Au over 18.3m, confirming strong gold mineralization. Additionally, bulk sampling from Giant Volney Pegmatite yielded lithium grades up to 5.4% Li₂O, demonstrating the project's lithium potential.

Furthermore, the Rusty Shear Zone is believed to be the source of over 420,000 ounces of historic placer gold production. The dual exposure to gold and lithium provides a diversified upside, especially at a time when both metals are in high demand.

Upcoming Catalysts: Why This Breakout Has Legs

This isn't just a technical move, as fundamental catalysts will continue driving momentum in the coming months.

The Q1 2025 drill mobilization will mark a major milestone as the company begins testing gold and lithium targets. By Q2 2025, investors can expect initial drill results, which could significantly re-rate the stock if they confirm high-grade discoveries.

Additionally, the macro environment is strongly favoring gold and lithium. Gold is breaking new highs, fueled by inflation, central bank buying, and macroeconomic uncertainty. Meanwhile, lithium prices appear to be putting in a low and gathering upside momentum, positioning Lion Rock to capitalize on the sector's next growth phase.

Final Thoughts: The Stars Are Aligning for Lion Rock

With the chart confirming a breakout, fresh capital secured, rock samples coming back from the assay labs pending, and a major exploration campaign about to launch, Lion Rock Resources (ROAR.V) is entering a transformational phase.

For investors looking at undervalued junior exploration plays, Lion Rock's current price levels represent a compelling risk-reward opportunity. With strong technical momentum, fundamental support, and upcoming drill results on the horizon, the company is poised for significant upside in the coming months.

| Want to be the first to know about interesting Gold and Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Lion Rock Resources.

- John Newell: I, or members of my immediate household or family, own securities of: Lion Rock Resources. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.