Clean technology company BioLargo Inc. (BLGO:OTCQX) announced its 2024 revenues through September 30 were 80% greater than in the same period last year.

Its third-quarter 2024 revenue of US$4.4 million increased 63% as compared to the third quarter of 2023, the company said.

"With one quarter still remaining, we've already secured a revenue record for 2024, making it our 10th consecutive year of record-setting growth," President and Chief Executive Officer Dennis P. Calvert said. "At the same time, we believe this growth is a mere fraction of our true potential. Each of our subsidiaries has huge potential to disrupt their respective markets and improve lives around the world. Based on our track record of growth and adoption in new business segments underway, we believe 2025 could shape up to be another record year."

BioLargo said its net loss for the quarter was US$1.1 million and US$2.6 million through September 30, 2024, compared to US$1.5 million and US$3.6 million for the same periods in 2023.

BioLargo is made up of several subsidiaries that work in different sectors, a "family of companies," including ONM Environmental, BioLargo Engineering, BioLargo Water, BioLargo Energy Technologies, Clyra Medical Technologies, and the new BioLargo Equipment Solutions & Technologies Inc. (BEST) subsidiary.

BioLargo is made up of several subsidiaries that work in different sectors, a "family of companies," including ONM Environmental, BioLargo Engineering, BioLargo Water, BioLargo Energy Technologies, Clyra Medical Technologies, and the new BioLargo Equipment Solutions & Technologies Inc. (BEST) subsidiary.

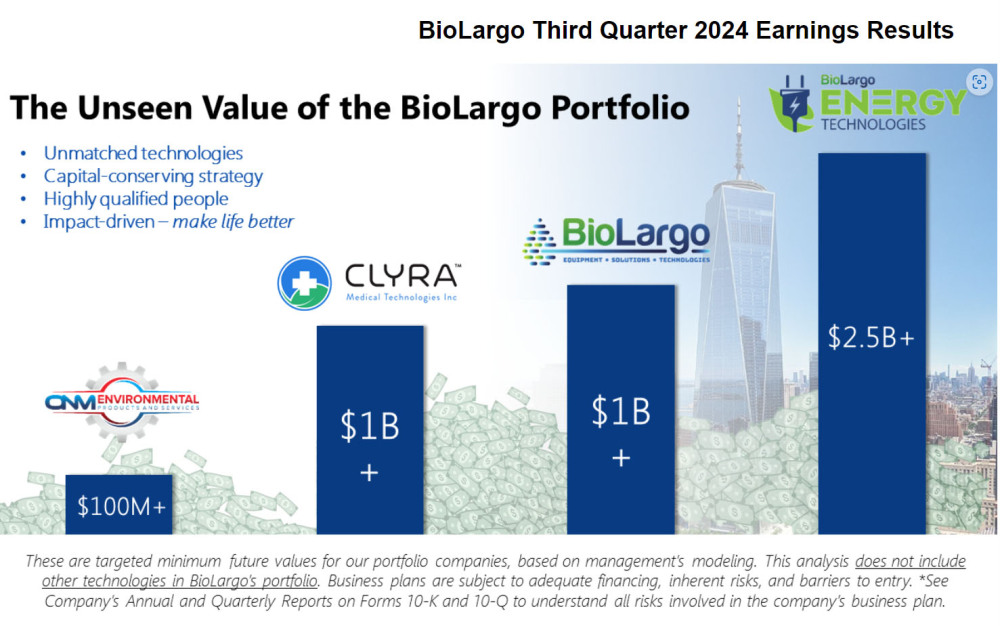

In a slide on its video call with shareholders and analysts about the earnings, the company detailed just how much it expects to grow, with estimated values or exit values for each portfolio company based on management modeling.

ONM Environmental, which includes the standout product pet odor control product Pooph, is targeted at more than US$100 million, the company said. Clyra Medical Technologies, which includes its copper-iodine wound irrigation solution, Bioclynse, is targeted to grow to more than US$1 billion, as is BEST, which has developed technology to remove "forever chemicals" from water to non-detectable chemicals. BioLargo Energy has developed a new long-lasting battery that the company said is safer than lithium-ion batteries and is targeted to grow to more than US$2.5 billion as the energy transition kicks into full gear.

During the call, Calvert said he believed Clyra will be the next subsidiary "to go big."

"This year, we made substantial investments in equipment and infrastructure in preparation for the anticipated national rollout of our subsidiary Clyra Medical Technologies' products," he said in a release. "Like all the technologies we develop at BioLargo, Clyra's products have features and benefits that are simply unmatched in the marketplace, which is why we are so excited to see these products adopted in the marketplace where they can make an impact for the greater good."

Singular Research Analyst Gowshihan Sriharan recently wrote that BioLargo is "significantly undervalued" and remained a Buy.

"We see significant upside potential in BLGO shares," wrote Sriharan.

Clyra Medical Technologies

Earlier this year, the company announced Keystone Industries had been selected to support manufacturing of Clyra's medical products.

Clyra's Bioclynse is "FDA 510(k) cleared, safe, highly effective, broad-spectrum wound irrigation solution with enormous potential to improve patient outcomes in applications like orthopedic surgery and dentistry," the company has said.

Some advantages include that its copper and iodine technology is non-cytotoxic, non-sensitizing, and does not damage tissue. It is non-staining with no rinse-out required, effective against biofilms, and has sustained efficacy for multiple days.

"There's a gap in that market, and we're going to fill it," Calvert said.

Fighting 'Forever Chemicals'

Also known as per- and polyfluoroalkyl substances (PFAS), "forever chemicals" are a group of thousands of synthetic chemicals used in everything from the linings of fast-food boxes and non-stick cookware to fire-fighting foams and other purposes.

BEST's Aqueous Electrostatic Concentrator (AEC) technology removes more than 99% of PFAS chemicals from water, the company has said.

Richard Ryan wrote for Oak Ridge Financial noted in a recent research note that BioLargo has an AEC municipal project in Stockholm, N.J., with a targeted installation of November and "the pipeline of opportunities is large and growing."

"The large emerging market for PFAS removal and BLGO's growing validation in this opportunity should not be overlooked," the analyst wrote, rating the stock a Buy with a base case target price of US$0.38 per share. "Modeling expectations are difficult to time, but we endeavored to incrementally include PFAS-related revenues and developed a bull case Price Target of $0.50."

Battery Could Address Long-Duration Energy Storage Needs

BioLargo Energy recently announced it had completed internal testing to validate key performance metrics for its Cellinity battery technology, which is designed to address long-duration energy storage needs.

The company said it confirmed the stability, reliability, and efficiency of Cellinity's chemistry, showing its ability to hold a charge without self-discharging and to charge and discharge quickly at high voltage.

A recent Economist article projects global energy storage needs to rise from 200 gigawatts today to over five terawatts by 2050.

"We're very excited about the future of this important battery technology," Calvert said, adding that Cellinity's safety, lifespan, and energy density make it well-positioned to contribute to the global energy transition.

Ownership and Share Structure

About 14.6% of BioLargo is owned by insiders and management, according to Yahoo! Finance. They include Chief Science Officer Kenneth Code with 8.44%, CEO Calvert with 3.32%, and Director Jack Strommen with 1.64%, Reuters reported.

About 0.04% is held by the institution First American Trust, Reuters said.

The rest, about 85%, is retail.

Its market cap is US$59.67 million, with about 300.62 million shares outstanding and about 259.05 million free-floating. It trades in a 52-week range of US$0.45 and US$0.16.

| Want to be the first to know about interesting Alternative - Cleantech investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- BioLargo Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of BioLargo Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.