Advantages of BioLargo's Sodium Sulfur Long-Duration Energy Storage (LDES) Battery:

Advantages of BioLargo's Sodium Sulfur Long-Duration Energy Storage (LDES) Battery:

- Safer

- Non-venting, sealed design

- Longer lasting

- Unlimited charge/discharge cycles

- 100% domestic supply possible

- No loss of energy when not being used (lithium loses up to 20% when not in use)

- Better, less expensive option for long-duration energy storage (LDES)

- No rare earth metal mining and therefore more eco-friendly

Battery energy storage will play a "pivotal" role in reducing carbon footprints globally, according to Energy5. "As the demand for clean energy continues to rise, it is crucial to invest in research, development, and implementation of battery storage technologies," the company wrote. "Embracing such innovative solutions will not only help combat climate change but also create a more resilient and sustainable energy infrastructure for generations to come."

"To realize the universal goal of net-zero emissions by 2050, the world is keenly looking at advancements in battery technology," wrote Jijo Malayil for Interesting Engineering.

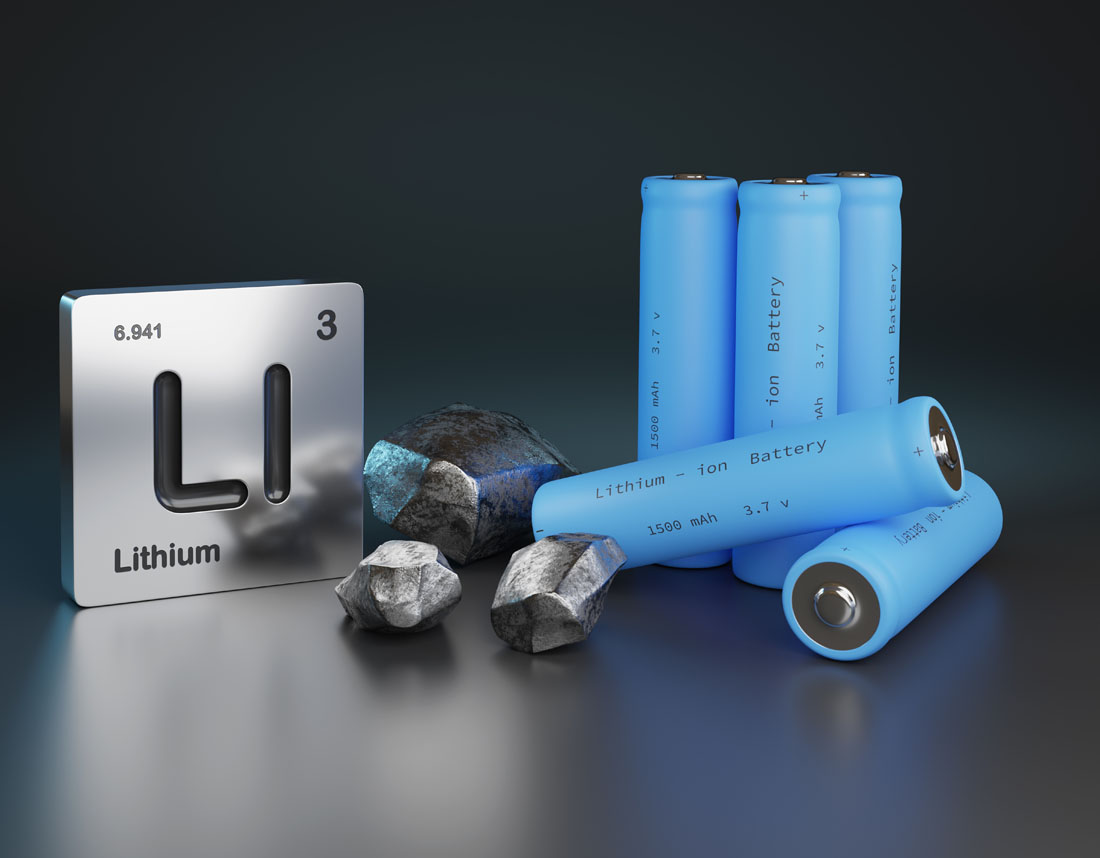

The need for lithium is expected to more than triple by 2030 to meet the demand for electrification. However, lithium may not be the only answer to these problems.

Sodium Batteries Taking Charge

While lithium has been spoken about plenty surrounding powering electric vehicles (EVs) in the battle to stop or slow climate change, a humbler element may also be on the table: Salt.

Sodium batteries have some advantages over lithium batteries. Lithium batteries can catch fire when damaged or improperly used.

They also function best when not fully charged or discharged.

According to an article in The Economist, "Lithium-ion (Li-ion) batteries have downsides. Lithium is scarce, for one.

And the best Li-ion batteries, those with layered-oxide cathodes, also require cobalt and nickel. These metals are scarce, too — and cobalt is also problematic because a lot of it is mined in the Democratic Republic of Congo, where working conditions leave much to be desired."

According to an article in The Economist, "Lithium-ion (Li-ion) batteries have downsides. Lithium is scarce, for one. And the best Li-ion batteries, those with layered-oxide cathodes, also require cobalt and nickel.

Because of lower costs and better availability, sodium batteries are perfect for large-scale applications, like storing solar energy for industry or even for your home.

According to Mordor Intelligence, the sodium-ion battery market is expected to register a compound annual growth rate (CAGR) of 14.68% from US$244 million in 2020 to US$609 million in 2027.

"Stationary energy storage is expected to dominate the market during the forecast period, and it is expected to be a significant application of sodium-ion batteries," Mordor said in its report. "The amount of energy generated by renewable sources, such as solar and wind, is increasing, and energy stores are essential to ensure the continuity of energy supply."'

And BloombergNEF has predicted sodium-ion batteries could displace about 7% of the lithium market by 2035.

BioLargo Inc.

Some companies are paying attention to this emerging sector and taking advantage of the benefits of this alternative battery material, like BioLargo Inc. (BLGO:OTCQB).

And Biolargo doesn't just understand the importance of entering the sector but how imperative it is for countries in the West to get involved in the battery space.

Western countries are also trying to shift dependence away from South America and China for battery metals. China has less than a quarter of the world's lithium resources but controls about two-thirds of the world's lithium processing and refining capacity, Rystad Energy reported.

"You need a solution that gets away from all of those performance (issues) and is a cost-effective, safe domestic supply," said Dennis Calvert, the president and chief executive officer of BioLargo.

BioLargo is another company moving forward in this space after acquiring similar sodium-sulfur battery technology this year, which it sees as an economical solution to the problems with lithium.

And BloombergNEF has predicted sodium-ion batteries could displace about 7% of the lithium market by 2035.

"You can never use 100% of (a lithium battery's) storage capacity," Calvert told Streetwise Reports. "And if you do, it degrades faster, which means less useful life. So, your total cost of operation is high."

Sodium-sulfur batteries offer four times the energy capacity and are less toxic, making them easier to recycle and more economical to produce, according to Interesting Engineering.

"When the sun isn't shining, and the breeze isn't blowing, we need high-quality (energy) storage solutions that don't cost the Earth and are easily accessible on a local or regional level," said researcher Dr. Shenlong Zhao of the University of Sydney.

Calvert said he pushes himself and his engineers because "We challenged them to take on some of the biggest engineering challenges of our time," Calvert said of his engineers. "We wanted to use less chemistry and electricity. Use less chemistry, less electricity, more efficiency, and more reuse. We would let nature work for us," he said.

Calvert said he pushes himself and his engineers because "We challenged them to take on some of the biggest engineering challenges of our time," Calvert said of his engineers. "We wanted to use less chemistry and electricity. Use less chemistry, less electricity, more efficiency, and more reuse. We would let nature work for us," he said.

"Our sodium-sulfur battery technology is not just an innovation; it's a game changer for the energy storage industry," Calvert continued. "With its unparalleled safety, longevity, and efficiency, it stands to play a pivotal role in the global transition to renewable energy."

The company said its long-duration energy storage (LDES) battery technology is safer, lasts longer, and is more energy-dense and efficient than other storage mediums. The units are made in the U.S. with no rare earth metals.

But most of all, the technology has already been through eight years of research and now has a commercial-ready design.

'Profitability on the Horizon'

BioLargo has another product that has been pushing the company toward profitability, and it's in a surprising market — pet odor control. The company has been developing safe, eco-friendly chemistries for a number of market applications for years, and one of them — "Pooph" pet odor eliminator — has made real headway toward becoming a blockbuster in the past year.

One analyst said that in addition to energy storage, it's the company's experience in this market and "BLGO's growing validation in this opportunity" that shouldn't be overlooked, Richard Ryan wrote for Oak Ridge Financial.

"Although BLGO has yet to break even, the rollout of Pooph puts profitability on the horizon," wrote Ryan, who rated the stock a Buy with US$0.35 per share price target.

More detailed regulations around tax credits for domestic clean energy manufacturing in the U.S. also have been released, according to Energy Storage News.

Technical Analyst Clive Maund rated the stock "a strong conservative buy for all timeframes" in a piece on his website, clivemaund.com.

The 45X Advanced Manufacturing Production Credit is one of several new ones brought in as part of the Inflation Reduction Act (IRA) at the start of 2023. However, unlike most others, 45X is paid directly to companies by the government rather than monetized by reducing an entity's tax liability.

According to the report, this makes manufacturing lithium-ion and other clean energy storage techniques immediately US$35 cheaper per kilowatt-hour to produce.

Analyst Michael Mathison of Singular Research was also bullish on the company, maintaining a Buy-Venture rating on the stock with a US$0.25 per share target price.

"With continuing rapid revenue growth, we project BLGO could achieve positive operating cash flow over the next two years," he wrote.

Technical Analyst Clive Maund rated the stock "a strong conservative buy for all timeframes" in a piece on his website, clivemaund.com.

"Although it is not a glamorous momentum play . . . (BioLargo) is considered to have substantial upside from here with the capacity to make faster gains than many consider possible, especially if there is anything to the sodium battery story," he wrote.

Looking at BLGO's chart, Maund noted that there "has been a big volume buildup and persistent heavy volume in the stock since 2019, which is viewed as bullish because it means that there has been a lot of stock rotation from weaker to stronger hands."

Chris Temple of The National Investor wrote that the company's "far superior technology" and "ever-improving finances" in several sectors make it a good investment.

"Most of the sellers are selling at a loss, and new buyers will be less inclined to sell until they have turned a profit," he continued. "The strongly rising Accumulation line throughout this period is most encouraging too as it reveals that most of this volume has been upside volume — this alone suggests that a new bullmarket is incubating."

Chris Temple of The National Investor wrote that the company's "far superior technology" and "ever-improving finances" in several sectors make it a good investment.

"BioLargo's share price is one of those that has not responded to the growing success," Temple wrote. "This, I.M.O., renders the company's shares among the better to be doubling down on as you can."

Ownership and Share Structure

About 14.6% of BioLargo is owned by insiders and management, according to Yahoo Finance. They include Chief Science Officer Kenneth Code with 8.67%, CEO Calvert with 3.41%, and Director Jack Strommen with 1.5%, Reuters reported.

About 0.04% is held by the institution First American Trust, Reuters said.

The rest, about 85%, is retail.

Its market cap is US$48.25 million, with about 288 million shares outstanding and about 247 million free-floating. It trades in a 52-week range of US$0.256 and US$0.15.

Want to be the first to know about interesting Battery Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- [BioLargo Inc.] is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of [BioLargo Inc.].

- [Steve Sobek ]wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.