Even though there has been virtually no movement in Tisdale Clean Energy Corp. (TCEC:CSE) since we last looked at it on December 8, so a month ago, it remains a potent setup that is continuing to gather strength and for this reason, I want to bring it to your attention again, especially as this is a junior uranium stock with an exceptionally low float and so has great upside potential, especially as the larger uptrend in the uranium sector looks like it will soon reassert itself.

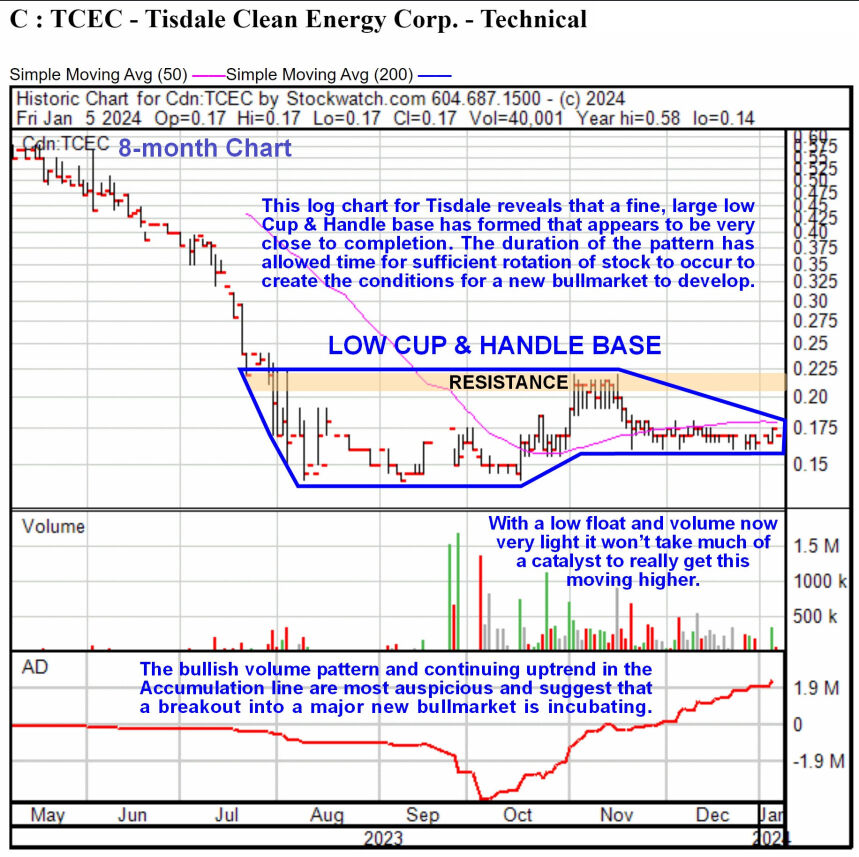

When I reviewed its chart yesterday, I realized that the use of a log chart instead of an arithmetic chart really "opens out" the base pattern, enabling us to see the fine Cup & Handle base (or Pan & Handle since it is still rather flat) to advantage.

On the 8-month log chart below, we can really see the base pattern well, and the three key points to note are that the pattern looks to be complete, or very close to complete, the Accumulation line continues to ascend strongly and make new highs, which calls for an upside resolution of the pattern, and last but not least, it is still at a very favorable entry price.

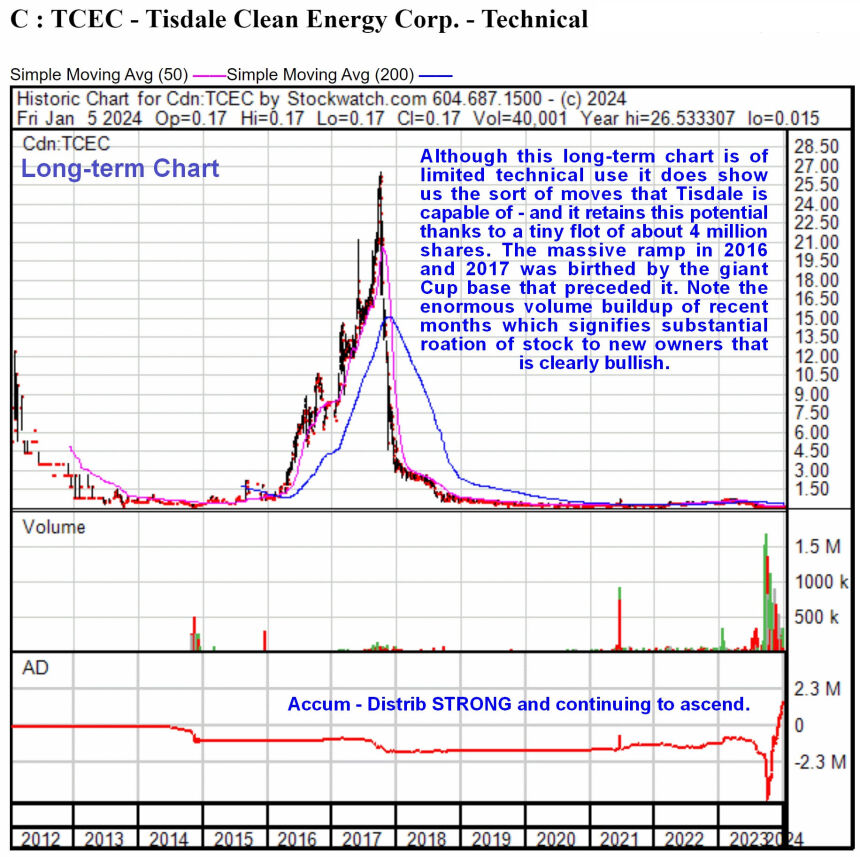

Whilst it is of limited use technically, the following long-term chart that goes back 12 years is also interesting as it shows the massive ramp in Tisdale in 2016 and 2017, and it is made all the more interesting by the realization that with only about 16 million shares in issue and only 4 million in the float, it is capable of making a similar move in the future and should be helped in this by the continuing bullmarket across the uranium sector.

So, whilst acknowledging that this is a low-priced stock that must be classed as speculative, for those who are comfortable investing and trading in such stocks, it is looking most attractive here and worth going overweight on while it is still at a low price.

Tisdale Clean Energy's website.

Tisdale Clean Energy Corp. closed at CA$0.17, $0.128 on January 5, 2024.

Originally posted on Clivemaund.com on January 8, 2024, at 6:40 am EST.

Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- [Tisdale Clean Energy Corp.] is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of [Tisdale Clean Energy Corp.].

- [Clive Maund]: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.