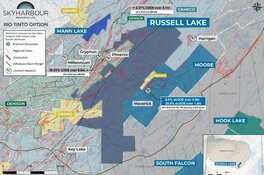

Tisdale Clean Energy Corp. (CSE: TCEC;OTCQB: TCEFF;FSE: T1KC) announced in a press release that it has confirmed plans to drill on its South Falcon East uranium project, located in the Athabasca basin, where it shares a 75% interest with its partner, Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE). The first phase of the project has a budget of CA$1.25 million. Tisdale stated that it had contracted Terralogic Exploration Inc. to conduct the drilling, and the program is based out of Skyharbour's McGowan Lake camp.

The company intends to begin 1,500m of drilling at the Fraser Lakes B Uranium Deposit soon, at the end of February 2024. The company hopes that drilling will confirm expected mineralization and that stepout drilling will expand mineralization estimates in preparation for an updated resource estimate. Drilling is also expected on anomalies in T-Bone Lake, which Tisdale stated may yield more mineralization.

Alex Klenman, Tisdale's CEO, commented, "The commencement of drilling is a milestone in terms of our ability to unlock the value contained at South Falcon. Right now, nobody is getting much credit for those pounds in the ground. This will begin to change as we drill and earn our interest in the project. The initial phase 1 plan allows us to meet the early obligations of the earn-in with Skyharbour. We are hopeful our valuation will grow as a result, therefore reducing the barrier to entry for institutional support and giving us the opportunity to implement larger drill programs moving forward through 2024 and beyond."

Support for Uranium Grows

As efforts continue around the world to reduce carbon emissions, many nations have shown renewed interest in nuclear energy. However, the increased demand for uranium has been complicated by the war in Ukraine, as Russia is one of the world's foremost producers of Uranium.

Technical Analyst Clive Maund rated the company as a "Strong Buy here for all timeframes." Maund noted that Tisdale's stock had reached highs of CA$26 in the past, demonstrating a capability to move upwards with significant momentum.

Japan recently classified uranium as a critical mineral in a move aimed at breaking its dependency on Russian uranium, reported Mining.com on February 1, 2024. Support for nuclear power declined in Japan following the Fukushima disaster, but the country has been turning its nuclear reactors back on, with 16 pending restarts.

As a result of rapidly increasing demand, uranium prices have reached soaring highs of CA$106 per pound, according to Katusa Research. Previously, the report stated that apathy and reactor shutdowns seemed to be the trend, so contrarian investors stand to make huge profits from this turnaround.

A Strong Buy

On January 30, 2024, Technical Analyst Clive Maund rated the company as a "Strong Buy here for all timeframes." Maund noted that Tisdale's stock had reached highs of CA$26 in the past, demonstrating a capability to move upwards with significant momentum.

Maund commented, "It only remains for the price to break above resistance, marking the upper boundary of the entire base pattern — once it does that, a major new bull market will ‘officially' have begun."

Michael Ballanger of GGM Advisor Inc. reviewed the company positively on January 16, 2024, and commented that investing in Tisdale "takes me out of the CA$90 million market cap . . . and into a CA$2.9 million market cap in TCEC, a 30-times differential."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Tisdale Clean Energy Corp. (CSE: TCEC;OTCQB: TCEFF;FSE: T1KC)

The company's investor presentation reports that, in terms of catalysts, the company has confirmed uranium mineralization in several zones across the South Falcon East project, and the company stated that results from this drilling program will be used to build an updated resource estimate.

Ownership and Share Structure

Refinitiv provided a breakdown of the company's ownership and share structure, where management and insiders in the form of CEO Alex Klenman own 4.43% of the company with 927,000 shares and an option to purchase 300,000 more.

Refinitiv reports that institutions in the form of Planet Ventures Inc. owns 5.95% of the company with 1.11 million shares.

According to Refinitiv, there are 29 million shares outstanding and 16.75 million free float traded shares, while the company has a market cap of CA$2.43 million shares and trades in the 52-week period between CA$0.14 and CA$0.72.

Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Tisdale Clean Energy Corp. and Skyharbour Resources Ltd. are a billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tisdale Clean Energy Corp. and Skyharbour Resources Ltd.

- Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.