Given the outlook for the uranium price and what Atha Energy Corp (SASKF:OTCMKTS; SASK:CA) has going for it, its stock is astoundingly cheap after its persistent downtrend this year.

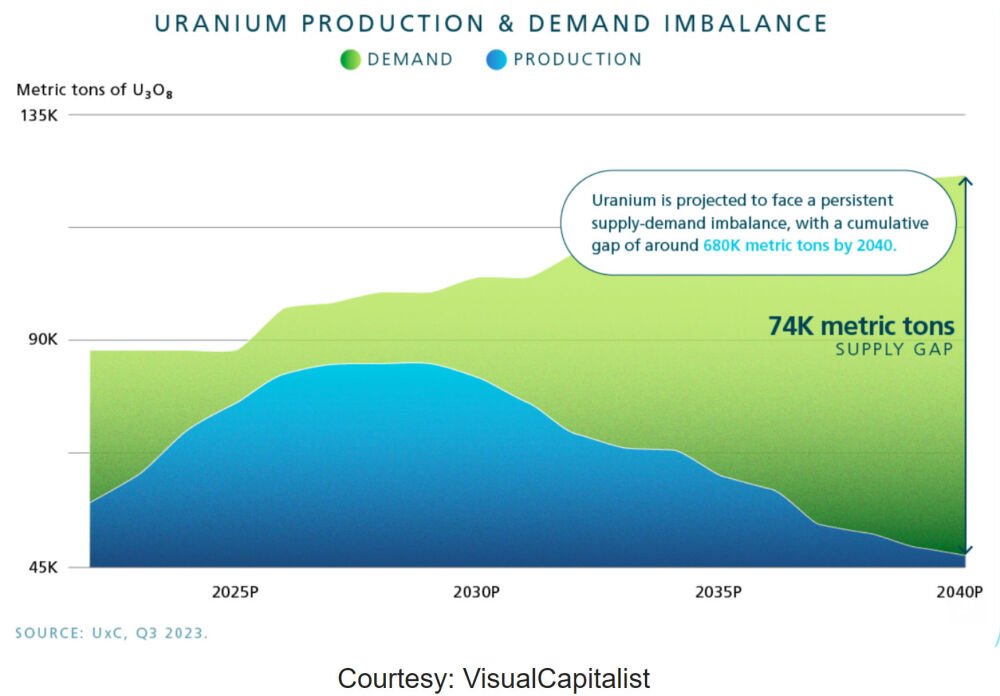

We'll start by looking at the supply /demand outlook for uranium.

The following chart projects a massive supply shortfall heading towards 2040.

Small wonder then that uranium is in a major bull market.

The following long-term chart for uranium makes clear that the drop this year is merely a correction along the way that should soon lead to renewed advance.

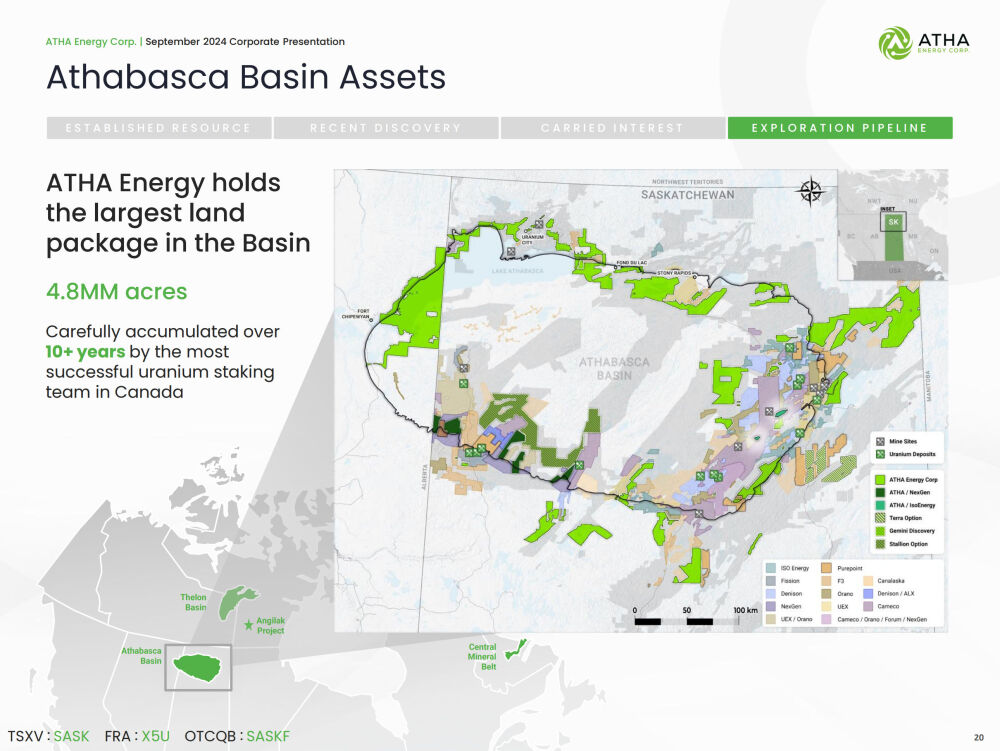

The big reason that Atha Energy is the standout "go to" investment in the sector is that it has acquired by far the largest land package in the prolific Athabasca Basin in Canada, having acquired an astounding 4.8 million acres and it also has the biggest land package in the nearby Thelon Basin, and these areas host every type of uranium.

As this slide from the company's latest investor deck makes clear, Atha's land portfolio in the Athabasca Basin is truly astounding.

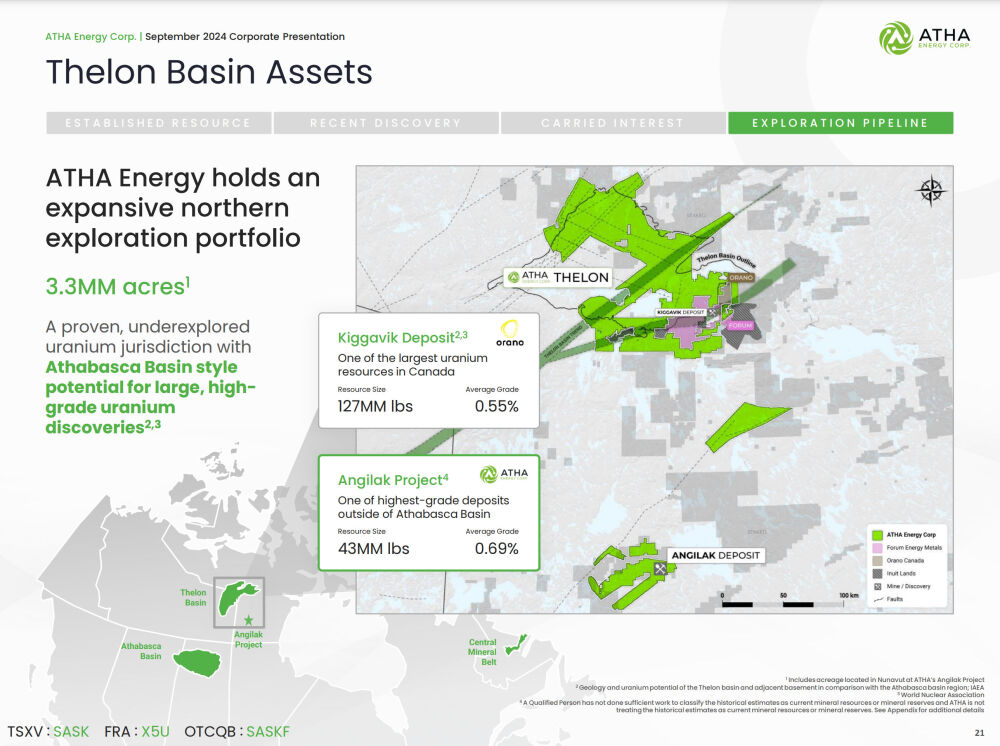

It also has the biggest land package in the nearby Thelon Basin.

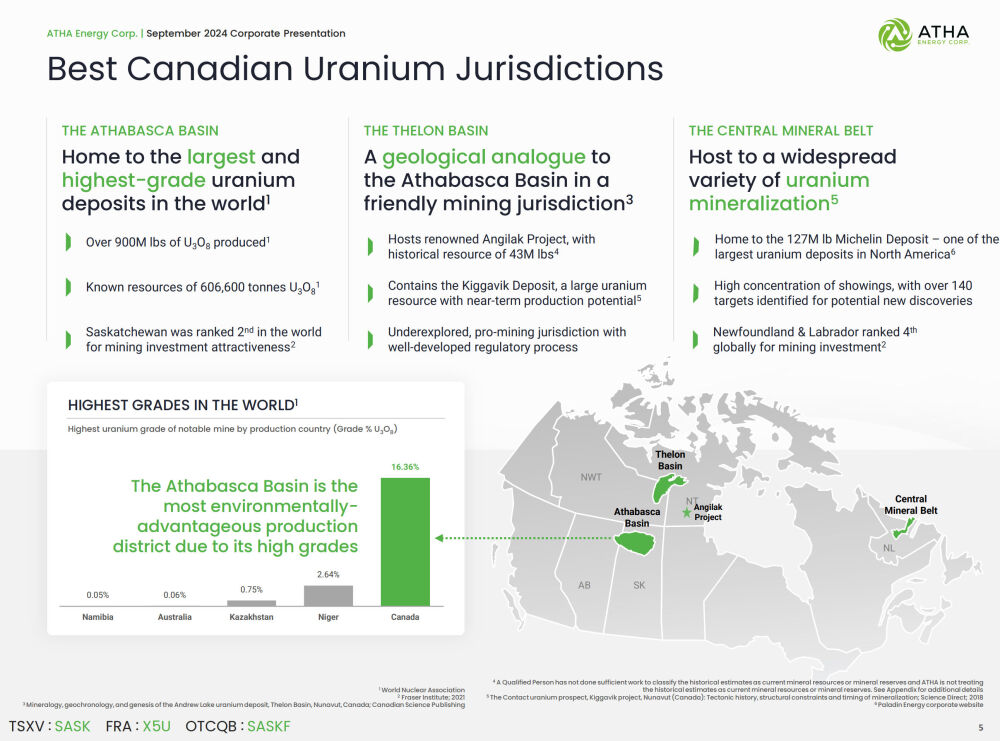

The following slide shows the areas where the company's assets are situated and lists their principal attributes.

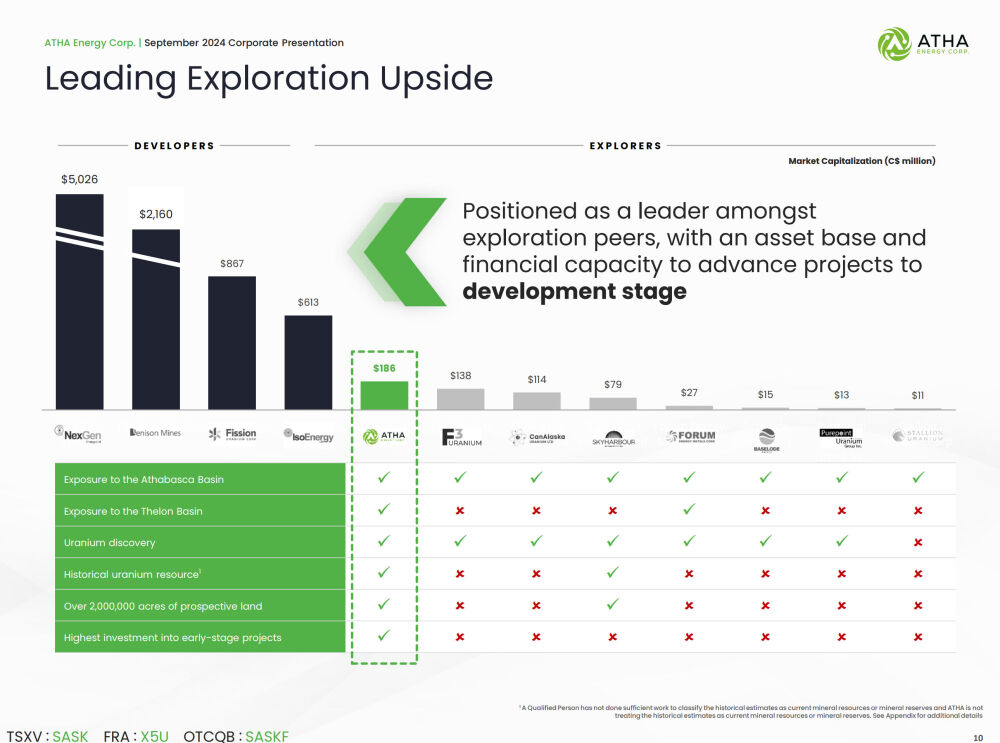

Atha is positioned as a leader amongst exploration peers.

A big catalyst for the sector is the news in September that Microsoft has intervened to secure its energy supplies by moving to restart the Three Mile Island nuclear plant. The significance of this is that it may obviously mark the start of a trend where Big Tech and other corporations with high power requirements take direct action to meet their power needs, even extending to the support of the nuclear power generation industry. So, this is viewed as a big catalyst for the uranium price going forward.

One more important point is that Atha is spending US$20 million on exploration just this year, including two drill programs and this clearly improves the prospect of good news.

The annotated charts below tell the story of why Atha Energy is such a Strong Buy here.

The conclusion must be that Atha Energy is THE top player in the uranium sector, and it is rated an Immediate Strong Buy.

Atha Energy Corp.'s website.

Atha Energy Corp (SASKF:OTCMKTS; SASK:CA) closed for trading at US$0.5531, CA$0.75 on October 16, 2024.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund